Access changes everything.

Traditional payment methods have left millions behind. Reach financially underestimated consumers and expand your customer base with an elite omnichannel Payment Experience (PX).

Access. Connection. Excellence.

The ACE framework is a strategic roadmap for smarter, faster growth with buy now, pay later (BNPL).

Access

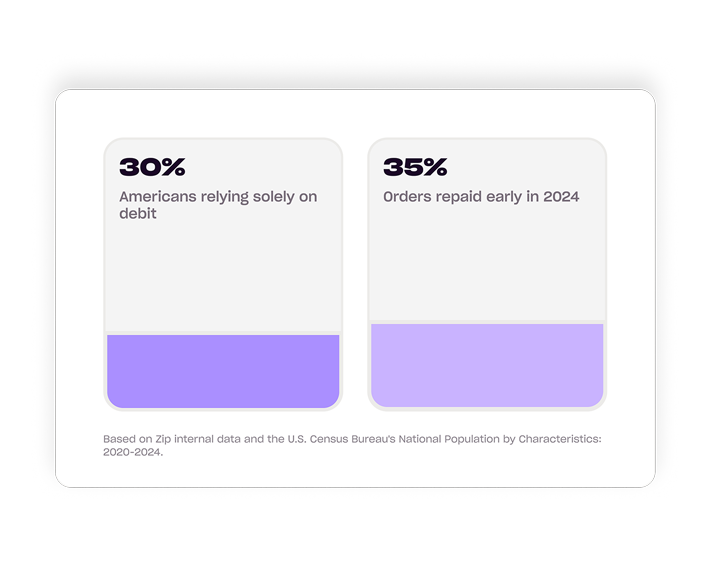

119 million Americans have been overlooked by traditional payment methods. Reach these financially underestimated consumers with a powerful alternative to credit.

Based on U.S. Census Bureau's National Population by Characteristics: 2020-2024. Numbers are reflective of unlocked customer segments of underestimated Americans and are not reflective of Zip's customer base.

119 million Americans have been overlooked by traditional payment methods. Reach these financially underestimated consumers with a powerful alternative to credit.

Based on U.S. Census Bureau's National Population by Characteristics: 2020-2024. Numbers are reflective of unlocked customer segments of underestimated Americans and are not reflective of Zip's customer base.

Connection

Recover and prevent lost sales with strategic PX placements throughout your customer journey.

Recover and prevent lost sales with strategic PX placements throughout your customer journey.

Excellence

Eliminate friction, maximize conversions, and deliver measurable ROI with flexible payment solutions.

Eliminate friction, maximize conversions, and deliver measurable ROI with flexible payment solutions.

Tap into a financially underestimated audience and unlock growth

Millions of shoppers are locked out by traditional payment methods—but they don’t have to be.

Millions of shoppers are locked out by traditional payment methods—but they don’t have to be.

Read our whitepaper

Reimagine the payment experience

Shoppers demand a seamless payment journey, and Zip’s PX meets them wherever they are.

An alternative to credit

Offer a flexible BNPL solution when debit or credit cards aren’t an option

Access anywhere

Build an omnichannel PX that spans online, in-store, in-app, and the Zip app.¹

Marketing resources

Educate shoppers about payment availability at key moments to secure the sale.

Strategic placements

Boost conversions and empower customers by offering them payment alternatives in real-time.

Pre-Qualification

Educate customers by letting them check BNPL eligibility before checkout.

PLCC Declines

Automatically suggest BNPL if a store credit card application doesn’t go through.

Second Chance Widget

Rescue sales by offering a BNPL option when a debit or credit card is declined.

Flexible payments, concrete results

Results are not representative, or guaranteed and may vary based on industry, company size and other criteria.

47%

Customer repeat rate

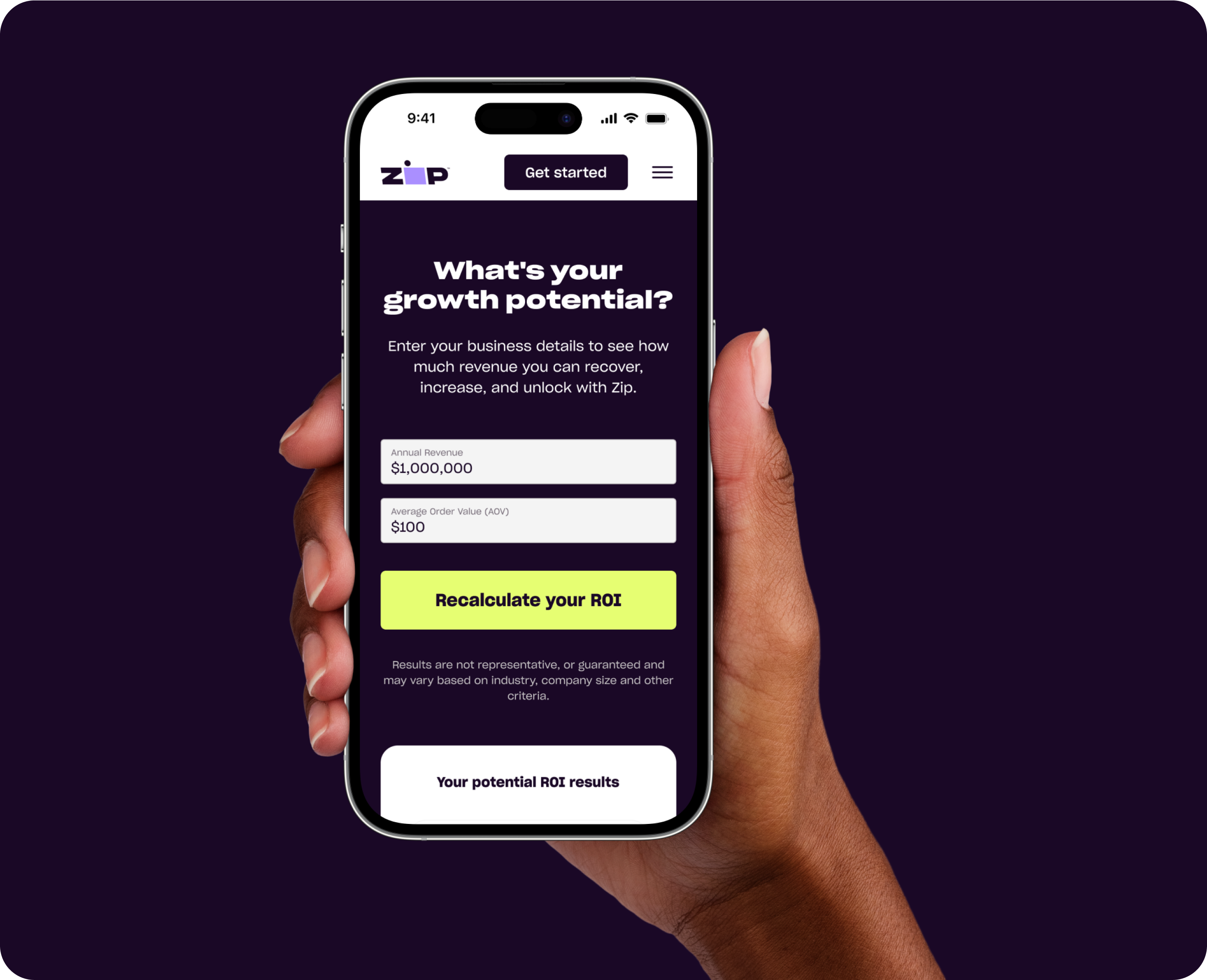

Discover your ROI instantly

Flexible payments aren't just convenient - they're a proven growth strategy.

Our interactive ROI calculator can help you measure missed revenue, basket size growth, and new audience reach.

Flexible payments aren't just convenient - they're a proven growth strategy.

Our interactive ROI calculator can help you measure missed revenue, basket size growth, and new audience reach.

Calculate my ROIAccess changes everything

Drive measurable growth by optimizing your PX and accessing financially underestimated customers.