Unlock new customers with flexible payments

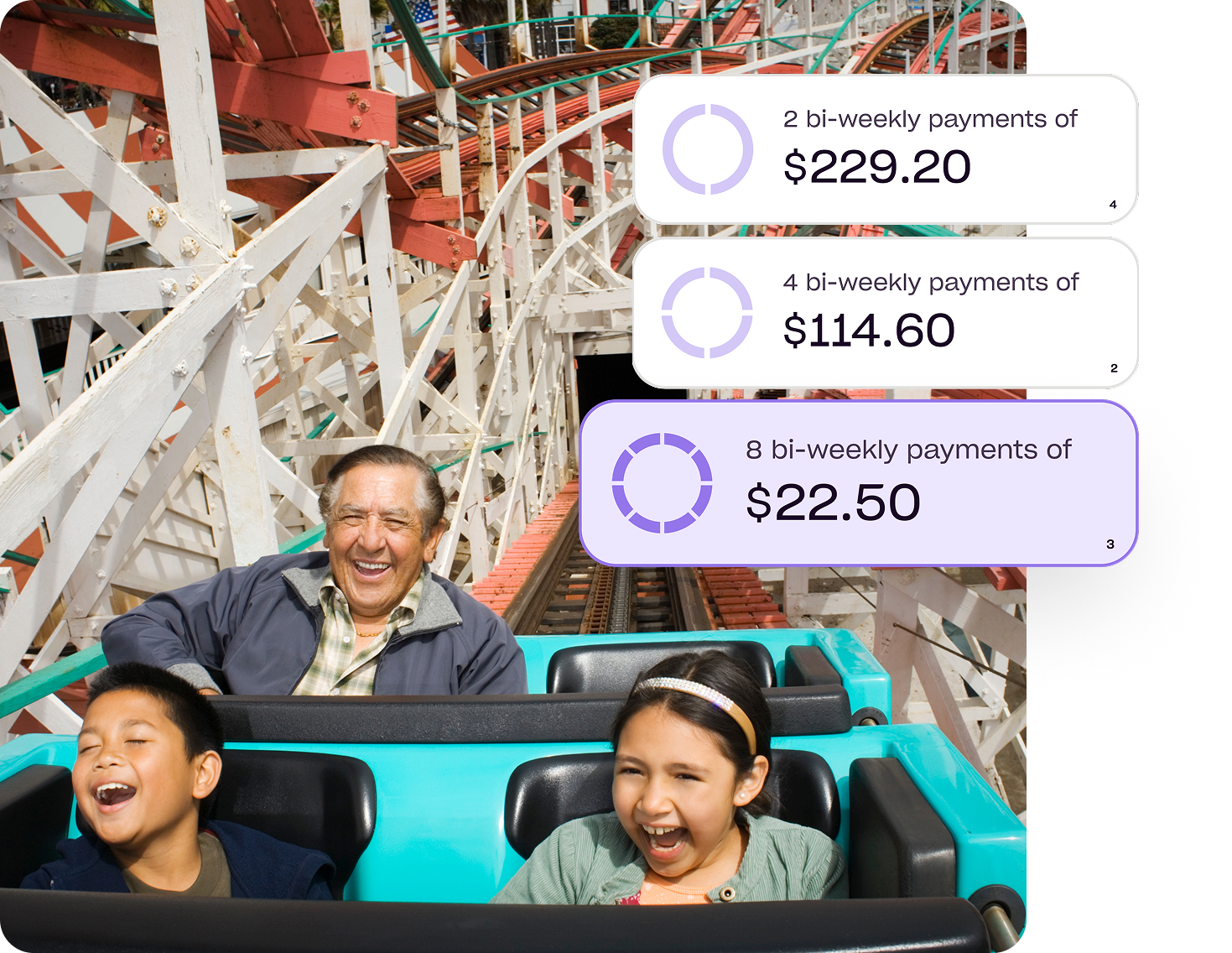

Give customers control over cash flow. They Pay in 2, 4, or 8 while you’re paid upfront. Zip drives higher conversions, larger baskets, new customers, and lasting loyalty.² ³ ⁴

Grow the metrics that matter

New, loyal customers: Inclusive payment options let you serve even more ready-to-buy customers

Higher AOV: Flexible installments allows customers to get what they need¹

Increased conversion: A seamless payment experience turns browsers into buyers

Lower cart abandonment: BNPL options stop sales from falling through the cracks at checkout

Faster growth: Zip helps merchants grow sales faster

New, loyal customers: Inclusive payment options let you serve even more ready-to-buy customers

Higher AOV: Flexible installments allows customers to get what they need¹

Increased conversion: A seamless payment experience turns browsers into buyers

Lower cart abandonment: BNPL options stop sales from falling through the cracks at checkout

Faster growth: Zip helps merchants grow sales faster

Pay in 2

You get paid upfront. Customers split payments into 2 equal installments over 2 weeks.2

You get paid upfront. Customers split payments into 2 equal installments over 2 weeks.2

Pay in 4

You get paid upfront. Customers split payments into 4 equal installments over 6 weeks.2

You get paid upfront. Customers split payments into 4 equal installments over 6 weeks.2

Pay in 8

You get paid upfront. Customers split payments in 8 equal installments over 14 weeks.2

You get paid upfront. Customers split payments in 8 equal installments over 14 weeks.2

Which installment option should you offer your customers?

Pay in 2 | Pay in 4 | Pay in 8 | |

|---|---|---|---|

Credit Limit | $20-$2,400 | $35 - $3,000 (A) | $200 - $3,000 (A) |

Merchant Payout in Full | Yes (B) | Yes (B) | Yes (B) |

Payment Period starts | When the order is placed (C) | When the order is placed (C) | When the order is placed (C) |

Number of installments | 2 | 4 | 8 |

Payment Frequency | Every 2 weeks | Every 2 weeks | Every 2 weeks |

Term | 2 weeks | 6 weeks | 14 weeks |

Repayment Method | Debit or credit card | Debit or credit card | Debit card |

Real time approval | Yes, No hard credit check | Yes, No hard credit check | Yes, No hard credit check |

Payment date change | 1 fee per month, then $2 fee for each additional PDC | 1 fee per month, then $2 fee for each additional PDC | 1 fee per month, then $2 fee for each additional PDC |

Interest | No revolving interest (D) | No revolving interest (D) | No revolving interest (D) |

Customer Contribution Fees | $0-$13.50 /order (E) | $0-$62 /order (E) | $0-$124 /order (E) |

A Can vary by merchant B Negotiated with merchant C At capture of order, minus merchant fees D A fixed fee applies which will be expressed as an APR and set forth in the disclosure to the customer E Negotiated with merchant based on AOV

Tangible bottom-line impact

Achieve smarter, faster growth with the help of Zip. Unlock new revenue with Zip’s ready-to-convert customer base.