Our products

Zip empowers its millions of customers with flexible financial solutions. Explore our products for each region.

United States

By looking beyond traditional credit scores, we can create more personalised and inclusive cashflow solutions for our customers.

Buy now, pay later

Shop online and in-store and pay in 2 payments over 2 weeks1, 8

Learn moreShop online and in-store and pay in 4 payments over 6 weeks2, 8

Learn moreShop online and in-store and pay in 8 payments over 14 weeks3, 8

Learn more

Australia

We give customers control in the way they pay, repay and manage their finances, whether for everyday purchases or next step in life, we’re with them every step of the way.

Everyday accounts

An interest free account with instant access to a digital Visa Card4

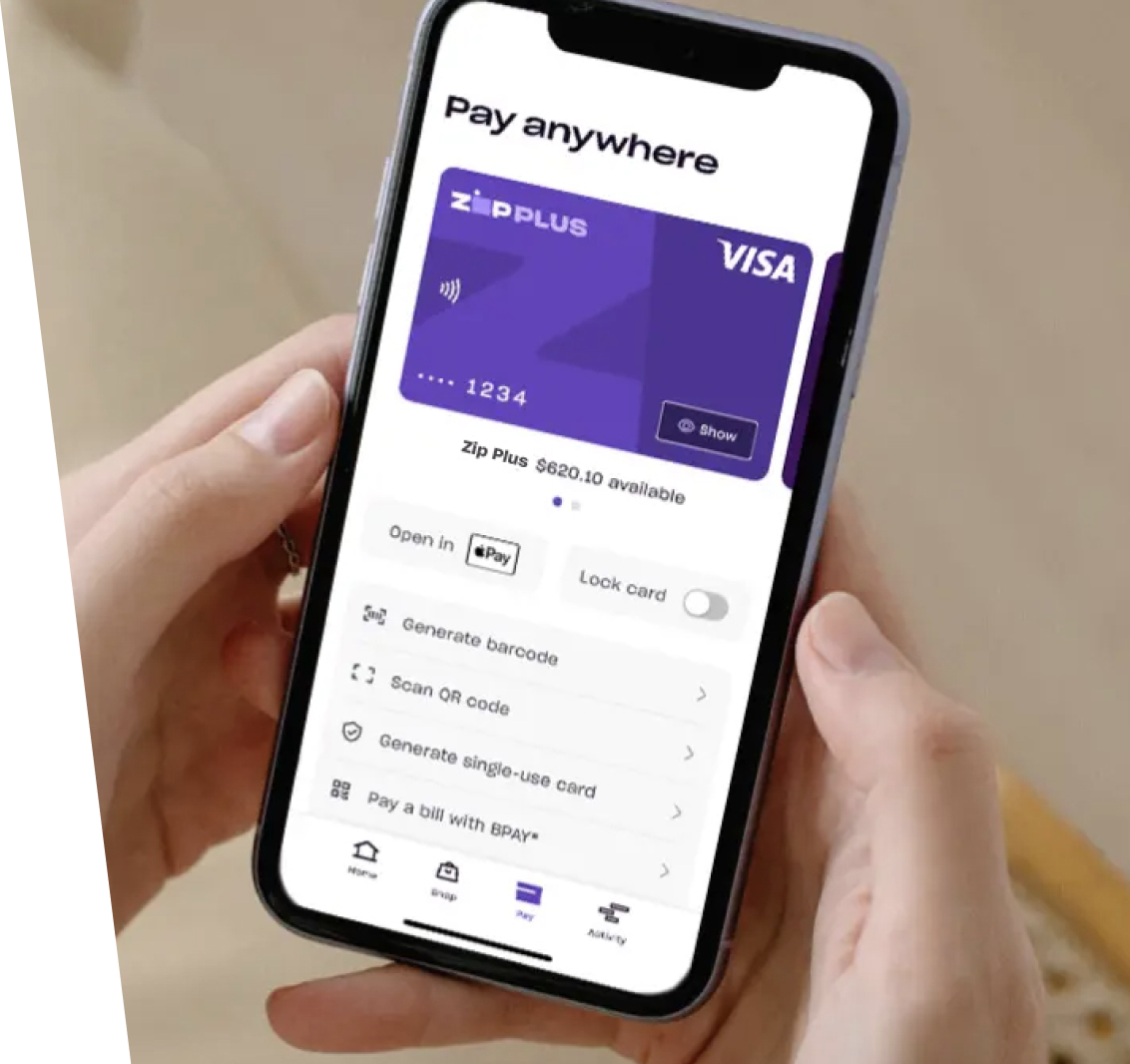

Learn moreA no-to-low-interest account with instant access to a digital Visa Card5

Learn more

Bigger purchases

A line of credit with built-in interest free terms6

Learn moreA loan that rewards responsible repayments7

Learn more

New Zealand

By providing flexible finance solutions, we help customers to manage cash flow and expenses with ease, making everyday purchases more manageable by spreading costs over time.

Buy now, pay later

Shop online and instore and pay in 4 interest free payments over 6 weeks9

Learn more

Merchant integrations

Zip is integrated with tens of thousands of merchants, helping them to boost sales, receive daily payment and address fraud risk.

Explore business solutions

References

- 1 For a $1,100 purchase, you'd make two $553.75 payments every two weeks starting today for a 35.70% annual percentage rate and a total of payments of $1,107.50. A $7.50 origination fee is charged at commencement - you pay this fee as a prepaid finance charge when you make your initial payment today. Actual origination fees vary and can range from $0.50 to $17 depending on the purchase price. The actual amount of the fee for your purchase will be reflected at checkout. Estimation of origination payment and annual percentage rate excludes potential tax and shipping costs. Financing through Zip issued by WebBank. All loans are subject to credit approval.

- 2 For example, for a $335 purchase, you'd make four $85.25 payments every two weeks starting today for a 31.11% annual percentage rate and a total of payments of $341. A $6 installment fee is charged at commencement - you pay $1.50 of this fee as a prepaid finance charge when you make your initial payment today. The remaining $4.50 is included in your future payments. Actual installment fees vary and can range from $0 to $7.50 depending on the purchase price and Zip product used. Actual amount of fee for your purchase will be reflected in checkout. Estimation of installment payment and annual percentage rate excludes potential tax and shipping costs. Zip Pay Anywhere and Zip Checkout financing through Zip issued by WebBank. All loans are subject to credit approval.

- 3 For a $400 purchase, you’d make eight $52.37 payments every two weeks starting today for a 34.99% annual percentage rate and a total of payments of $418.97. An $18.97 origination fee is charged at commencement and prepaid as a finance charge when you make your initial payment today. Origination fees vary and can range from $9.48 to $85.37, depending on the purchase price. Actual amount of fee for your purchase will be reflected in checkout. Estimation of origination payment and annual percentage rate excludes potential tax and shipping costs. Financing through Zip issued by WebBank. All loans subject to credit approval.

- 4 Zip Pay: Minimum monthly repayments are required. A monthly account fee of $9.95 applies and is subject to change. Pay your closing balance in full by the due date each month and we’ll waive the fee. Available to approved applicants only and subject to completion of satisfactory credit assessment. Other charges may be payable. Fees and charges subject to change. T&Cs apply. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878. Visit zip.co/au/zip-pay to find out more.

- 5 Zip Plus: Interest accrues daily on the total balance owing at the end of each day. No interest will be charged to your account in a given month if the balance owing at the end of the last day of that calendar month is $1,500 or less. Each day ends at 11:59pm AEST (AEDT during daylight savings). Standard interest rate is 12.95% p.a. T&Cs and credit approval criteria apply. A monthly account fee of $9.95 will apply if the total balance owing is not paid in full by the end of the last day of the calendar month. Interest and other charges may be payable, see T&Cs. Interest, fees and charges subject to change. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- 6 Zip Money: The interest free period is the maximum period of time when no interest is charged on the purchase. The availability of the interest free period for a purchase will depend on the purchase amount, the minimum monthly repayment and account status. Minimum monthly repayments are required and vary according to credit limit. Minimum monthly repayments may require repayment of the purchase prior to the expiry of the maximum interest free period. In other cases, paying only the minimum monthly repayment may not repay the purchase in the interest free period. Any purchase amount outstanding at the expiry of the interest free period will be charged at the standard variable interest rate, 25.9% per annum, as at 1 June 2023. Zip Money is available to approved applicants and subject to completion of a satisfactory credit assessment. A monthly account fee of $9.95 applies and a one-off establishment fee may apply for new customers. Other charges may be payable, see T&Cs. Interest, fees and charges are subject to change. Terms and Conditions apply and are available on application. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- 7 The rate drop is applied at the end of each anniversary year. To be eligible for an annual rate drop, you must, during the anniversary year, make all repayment amounts by the due date each month on your personal loan and any other accounts you hold with Zip. If you miss any repayments or are in default under your loan agreement or any of your other Zip accounts at any time, you will not be eligible for an annual rate drop on your next anniversary date, but you may be eligible in subsequent anniversary years if you meet the criteria during those anniversary years. You may not receive the full benefit of annual rate drops if the variable interest rate increases, which may happen from time to time.

- 8 Zip can only be used for US purchases. Certain merchant, product, goods, and service restrictions apply.

- Zip Pay, Zip Plus, Zip Money and Zip Personal Loan: Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- 9 NZ Zip Pay in 4 T&Cs and late fees apply. Approved applicants only and subject to completion of satisfactory credit checks. Zip Co NZ Finance Limited FSP 598969.