For everyday,

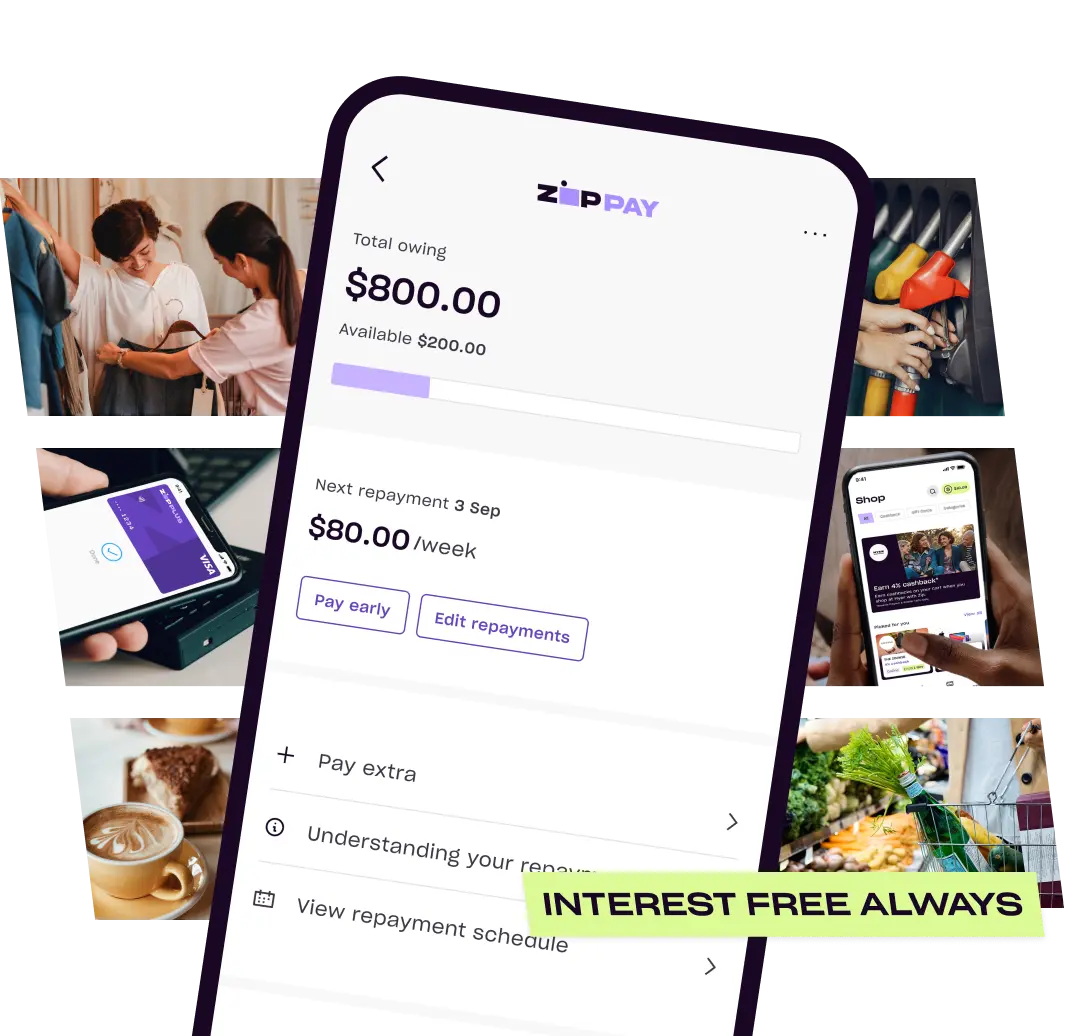

there's Zip Pay

Apply for up to $1,000 to spend, interest free always.

Sign up to Zip Pay

Why choose Zip Pay?

Zip Pay is a fast, secure and easy way to get what you need today and repay it on a schedule that suits you, interest free.1

Flexible repayments

Choose a weekly, fortnightly or monthly schedule. Pay off early if you like, without a penalty.

Pay later, interest free

Every transaction you make with Zip Pay is interest free, always.

Approval in minutes

Apply in minutes, with no establishment fees and nothing to pay today.

Up to $1,000 to spend.

Interest free always

Nothing to pay today, no hidden fees, and no interest, ever.

$0 establishment fee

We don’t charge you anything to open a Zip Pay account. Start shopping right away with nothing to pay upfront.Interest free, always

We don’t charge interest on your purchases, and we never will.$9.95 monthly account fee

Waived if you pay your statement closing balance in full before the due date.Pay your statement closing balance, in full, by the due date and we'll waive the fee.From $10/week flexible repayments

Choose weekly, monthly or fortnightly repayments. Repayments start from just $10 per week. Minimum monthly repayments apply.$350-$1,000 credit limit

Once you're approved we'll confirm your account credit limit.You may be eligible for a credit limit increase once you've been using your account for at least 6 months.

Need a larger limit?

Explore Zip Money

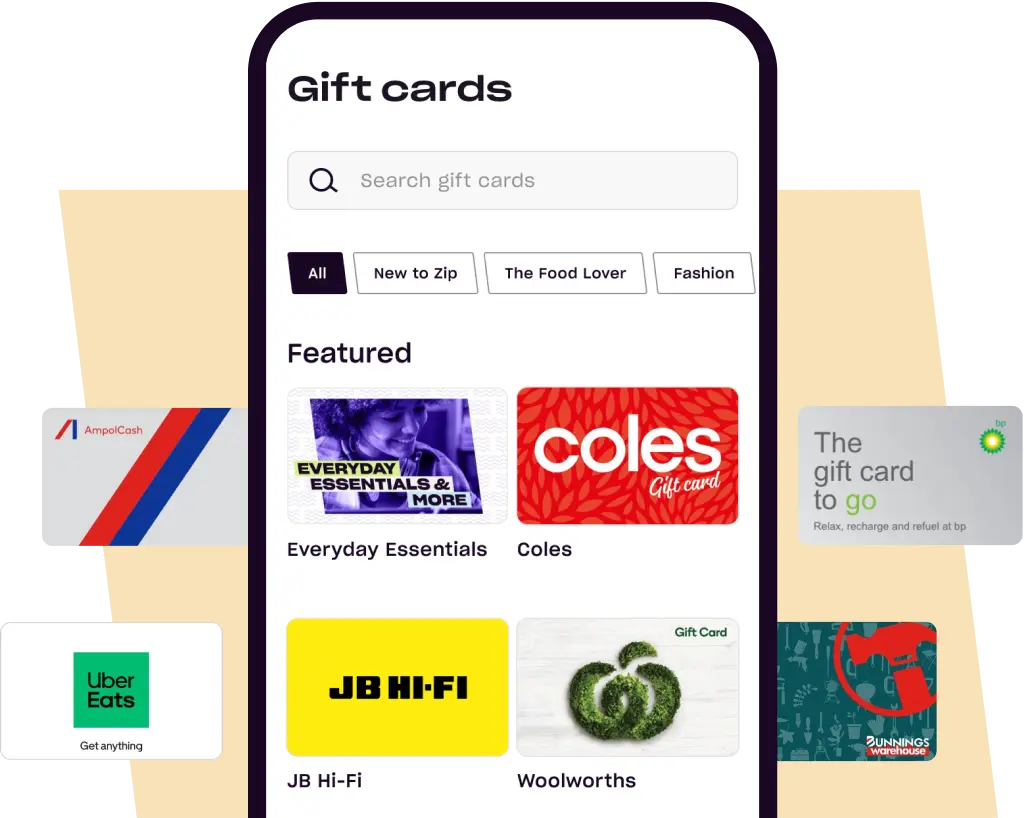

Purchase gift cards on the app

The perfect present, delivered in seconds. Choose from over 200 great brands with flexible amounts from $25 to $1000. Add a personal message, and send it now or schedule it for that special day. Gift card T&Cs apply.

Shop gift cards

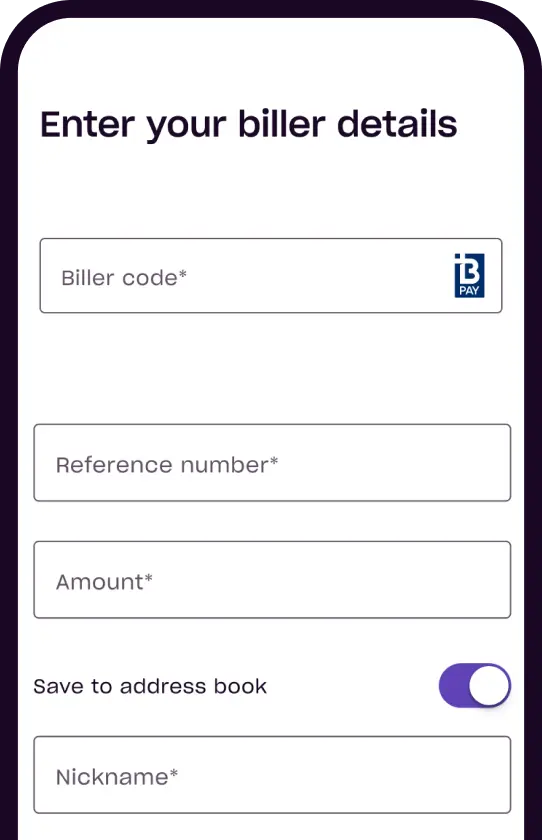

Pay your bills

Use Zip with over 60,000 BPAY® Billers and spread the cost of your bills over time.2

Earn instant cashback

Not only are we flexible, we're rewarding too. Earn instant cashback when shopping at our rewards partners.

Download the Zip app to browse and activate our range of offers.*

Shop cashback offers

Spend with Zip Pay just about anywhere

Online shopping

Online shopping made easy

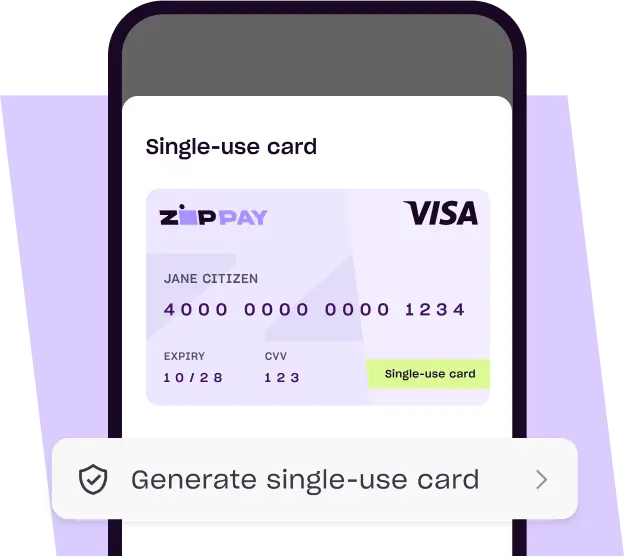

Your Zip Pay Visa Card works online anywhere Visa is accepted, even when you don't see Zip at checkout.** Just access your card details from the Zip app.

Open the ‘Pay’ tab in the Zip app

Tap your Zip Pay Visa Card

Use the card details to complete your purchase

Instore shopping

Tap your Zip Pay Visa Card

From grabbing a coffee to filling up the tank, pay with a tap of your phone. Add Zip Pay to your digital wallet and pay anywhere Visa is accepted.**

Open the ‘Pay’ tab in the Zip app

Add your Zip Pay Visa Card to your phone’s digital wallet

Tap your phone instore anywhere you see Visa or the Contactless Symbol

How do Zip Pay repayments work?

We have 2 repayment options:

- Choose your repayments: Set your repayment amount, date and frequency to suit you - weekly, fortnightly or monthly.

- Fee waiver: Zip will automatically adjust your Zip Pay repayment schedule to pay off your full balance owing each month, so that you don't have to pay the monthly account fee.

Frequently Asked Questions

Zip Pay is an interest free buy now pay later product offering a credit limit of up to $1,0001. You can buy what you love and enjoy the flexibility of paying it off over time.

- Apply in under 4 minutes and start shopping instantly once approved -Instant access to a digital Visa card that works online and instore, anywhere Visa is accepted **

- Repay from $10/week A $9.95 monthly account fee applies, waived if nothing owing.

Zip Plus is a great value digital card with interest free and waived fee options. You’ll have more spending power than Zip Pay, with access to a credit limit of $2,000-20,0003.

- Use Zip Plus instore and online everywhere Visa is accepted

- Reduce your owing balance to $1,500 at the end of each month and you’ll pay no interest at all. If your owing balance is over $1,500 at the end of the month, a low interest rate of 12.95% p.a applies.

- Repay from $20/week

- Shop globally, with no foreign transaction fees

- A $9.95 monthly account fee applies, waived if there is no balance owing at the end of each month.

Zip Money is a line of credit with limits between $1,000 and $5,000 when customers apply directly with Zip, or $50,000 when customers apply through select Zip merchants. Up to 5 years interest free terms available4.

- Repay from $10/week

- A one-off establishment fee for certain credit limits may apply

- A $9.95 monthly account fee applies, waived if nothing owing at the end of each month.

Zip Pay and Zip Plus are perfect for everyday purchases. Both come with instant access to a Zip Visa Card for online and instore shopping, anywhere Visa is accepted**. Whether it’s your weekly groceries, buying new shoes online or filling up the petrol tank - Zip works everywhere.

For instore purchases, you can add the Zip Visa Card to your phone’s digital wallet. When you’re ready to pay at the checkout, just tap your phone anywhere Visa is accepted - even when you don’t see Zip at checkout**.

For online purchases, your Zip Visa Card details are available in the Zip app. Simply paste the card details at any online checkout that accepts Visa**.

See the full list where you can shop with Zip in our store directory.

Shop everywhere online where Visa is accepted with Zip's single-use card feature on the Zip mobile app. Or shop anywhere instore you see Zip at checkout - we've partnered with 55,000+ retail stores.

Additionally, you can use your Zip account to pay BPay bills** and buy gift cards for food, fuel and groceries.

- Repayments are automatically direct debited from the payment method that you added when you created the account. You can change the payment method at any time and the frequency of your payments to weekly, fortnightly or monthly as long as you're covering the minimum monthly repayments. Choose what works best for you.

Zip Pay:

- Monthly Account Fee: $9.95 (waived if you pay your statement closing balance in full by the due date).

- Late Fee: $7.50 if you miss the minimum repayment, charged 7 days after your due date.

- BPAY Bill Payment Fee: $2.50 per bill payment.

- Foreign Exchange Fee: If you use a Zip Visa Card or a Single-Use Card to make a 'Foreign Transaction' (being a transaction made with a merchant or processed by a financial institution located outside Australia), a fee charged at 3% of the value of the foreign transaction.

Zip Plus:

- Monthly Account Fee: $9.95 (waived if you do not have an outstanding balance at the end of the month).

- Interest:

- 12.95% p.a. if your balance is over $1,500.

- No interest if your balance is $1,500 or less.

- Late Fee: $15 if the minimum repayment isn’t made, charged 7 days after your due date.

Zip Money:

- Monthly Account Fee: $9.95 (waived if you do not have an outstanding balance at the end of the month).

- One-off Establishment Fee: $0 - $99, depending on your approved credit limit.

- Late Fee: $15 if the minimum repayment isn’t made, charged 7 days after your due date.

- BPAY Bill Payment Fee: $2.50 per bill payment.

- Foreign Exchange Fee: If you use a Single-Use Card to make a 'Foreign Transaction' (being a transaction made with a merchant or processed by a financial institution located outside Australia), a fee charged at 3% of the value of the foreign transaction.

Zip Personal Loan:

- Monthly Account Fee: $9.95

- One-off Establishment Fee: $199 applied to the balance owing on your loan once disbursed.

- Late Fee: $25 if the minimum repayment isn’t made, charged 21 days after your due date.

References

- T&Cs, fees and credit approval apply. Other charges may be payable. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- Apple, Apple Pay and the Apple App Store are trademarks of Apple Inc., registered in the U.S. and other countries and regions. Google, Google Pay, Google Play and the Google Play logo are trademarks of Google LLC. VISA is a trademark owned by Visa International Service Association and used under license. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC.

- 1 Zip Pay: Minimum monthly repayments are required. A monthly account fee of $9.95 applies and is subject to change. Pay your closing balance in full by the due date each month and we’ll waive the fee. Available to approved applicants only and subject to completion of satisfactory credit assessment. Other charges may be payable. Fees and charges subject to change. T&Cs apply. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878. Visit zip.co/au/zip-pay to find out more.

- 2 Payments may take up to 5 business days to reach your Biller. Certain Biller exclusions apply including but not limited to credit institutions, gambling, share trading, personal loans and DEFT rent. A $2.50 processing fee may be payable for each transaction processed using Zip Pay (to a maximum of $1000) or Zip Money. The amount of the fee will be advised and authorised by You at the time of any relevant bill payment. Exceptions may apply. ® Registered to BPAY Pty Ltd ABN 69 079 137 518

- * Rewards are redeemable when you reach the Rewards Goal. See Promotion and Reward Program T&Cs for more details. Zip may earn a commission.

- ** Zip Visa Card is available with Zip Pay and Zip Plus. Zip Visa Card T&Cs apply.

- 3 Zip Plus: Interest accrues daily on the total balance owing at the end of each day. No interest will be charged to your account in a given month if the balance owing at the end of the last day of that calendar month is $1,500 or less. Each day ends at 11:59pm AEST (AEDT during daylight savings). Standard interest rate is 12.95% p.a. T&Cs and credit approval criteria apply. A monthly account fee of $9.95 will apply if the total balance owing is not paid in full by the end of the last day of the calendar month. Interest and other charges may be payable, see T&Cs. Interest, fees and charges subject to change. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- 4 Zip Money: The interest free period is the maximum period of time when no interest is charged on the purchase. The availability of the interest free period for a purchase will depend on the purchase amount, the minimum monthly repayment and account status. Minimum monthly repayments are required and vary according to credit limit. Minimum monthly repayments may require repayment of the purchase prior to the expiry of the maximum interest free period. In other cases, paying only the minimum monthly repayment may not repay the purchase in the interest free period. Any purchase amount outstanding at the expiry of the interest free period will be charged at the standard variable interest rate, 25.9% per annum, as at 1 June 2023. Zip Money is available to approved applicants and subject to completion of a satisfactory credit assessment. A monthly account fee of $9.95 applies and a one-off establishment fee may apply for new customers. Other charges may be payable, see T&Cs. Interest, fees and charges are subject to change. Terms and Conditions apply and are available on application. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.