A credit limit.

Not a

credit card.

Apply today

A credit limit for your everyday, plus more

Book that weekend away or transform your living space. Whatever tomorrow holds, nothing is holding you back.

No interest or low interest

Interest free when your end of month balance is under $1,500. And a low rate of 12.95% p.a. when it's over $1,500.1

No foreign transaction fees

Pay no foreign transaction fees when you shop instore while you travel or when buying from overseas websites.

Up to $20,000 to

spend everywhere

Visa is accepted

Repayments from $20/week2

Nothing to pay today & no hidden fees

Interest free when your owing balance at the end of each month is under $1,500

12.95% p.a. when your owing balance at the end of each month is over $1,500

- $9.95 monthly account feeWaived if nothing owing at the end of each month

Repay from $20/week flexible repayments

$2,000-$20,000 credit limit

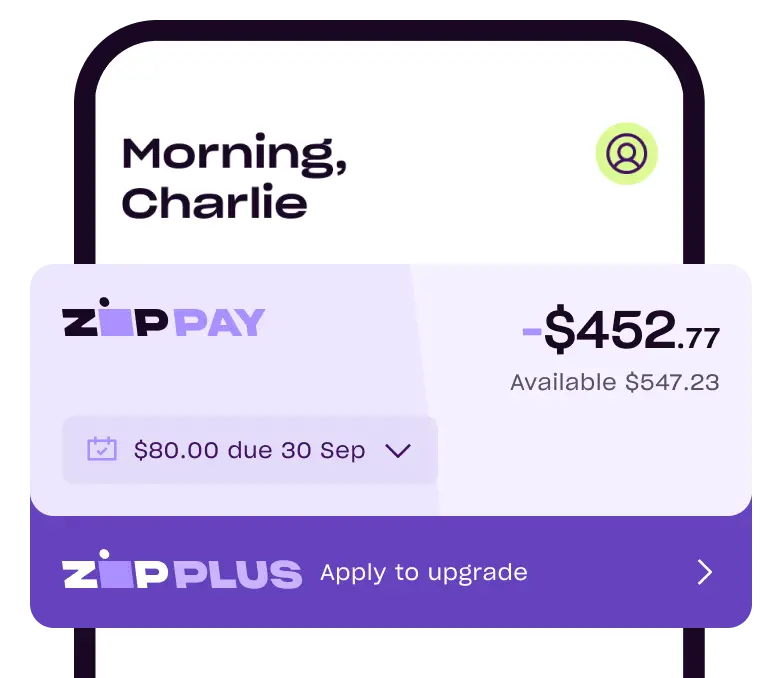

Upgrade from Pay to Plus

When you upgrade to Zip Plus, we'll close your Zip Pay account and transfer any owing balance to your new Zip Plus account.

Pay your way with Zip Plus

Online and instore

Get instant access to the Zip Plus Visa Card. It works online and instore, anywhere Visa is accepted - even when you don't see Zip at checkout.*

Zip digital gift cards

The perfect pressie, delivered in seconds. Choose from over 100 brands, add a personal message, send now or schedule for that special day. Gift Card T&Cs apply.

Pay BPAY® Billers

Use Zip Plus with over 60,000 BPAY® Billers and spread the cost of your bills over time.3

Frequently Asked Questions

Zip Plus can be used anywhere Visa is accepted. The Zip Visa Card works online and instore, even when you don’t see Zip at checkout. Whether it’s weekly groceries, buying new shoes online or filling up the petrol tank - Zip Plus works everywhere.

Your Zip Plus Visa Card can be set up instantly right after your account is approved, so you don’t have to wait to start shopping.

Add the Visa card to your phone’s digital wallet for easy instore shopping or use the Zip app for Visa card details that can be used online.

Plus, you can check out online and shop instore at any of our Zip Retail Partners using your Zip app.

Minimum monthly repayments are a fixed amount dependent on your credit limit. For example, a $4,000 credit limit would have a $120 minimum monthly repayment. However, if your outstanding balance is lower than this fixed amount, your minimum will be the total outstanding balance for that month. Explore all our limits and associated minimum monthly repayments.

Please note monthly account fees, interest and other charges may apply. Standard interest rate is 12.95% p.a. Refer to the below FAQ for further details about this.

Fee/Cost Terms Monthly Account Fee $9.95/month Waived if $0 owing at the end of each calendar month. Interest Interest free when your owing balance is under $1,500 at the end of each calendar month. 12.95 % p.a. if your owing balance is above $1,500 at the end of each calendar month. Late Fee If the minimum monthly payment amount (or your remaining balance if less than the minimum) is not met, you will incur a $15 late fee. It will be charged 7 days after your contractual due date. Foreign Transaction Costs No charges apply. Zip Plus has 2 repayment options:

- Choose your repayments: Set your repayment amount, date and frequency to suit you. You can repay weekly, fortnightly or monthly.

- Autopay balance: your repayment schedule will automatically repay your total owing balance at the end of each month so you won't be charged interest or the monthly account fee.

All repayments are direct debited from the payment method you nominate when setting up your account. You can change your payment method and the frequency of your repayments at any time as long as you're covering your minimum monthly repayment amount. Choose what works best for you!

When you switch to Zip Plus, your Zip Pay account will be closed and any owing balance will be transferred to your new Zip Plus account. If you are entitled to a refund on your Zip Pay account after closure, it will be credited to Zip Plus. Interest will accrue daily on the transferred balance and will be charged to your account if you owe more than $1,500 at the end of the month.

More info about upgrading from Zip Pay to Zip Plus can be found in our Help Centre here.

References

- T&Cs, fees and credit approval apply. Other charges may be payable. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- Apple, Apple Pay and the Apple App Store are trademarks of Apple Inc., registered in the U.S. and other countries and regions. Google, Google Pay, Google Play and the Google Play logo are trademarks of Google LLC. VISA is a trademark owned by Visa International Service Association and used under license. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC.

- 1 Zip Plus: Interest accrues daily on the total balance owing at the end of each day. No interest will be charged to your account in a given month if the balance owing at the end of the last day of that calendar month is $1,500 or less. Each day ends at 11:59pm AEST (AEDT during daylight savings). Standard interest rate is 12.95% p.a. T&Cs and credit approval criteria apply. A monthly account fee of $9.95 will apply if the total balance owing is not paid in full by the end of the last day of the calendar month. Interest and other charges may be payable, see T&Cs. Interest, fees and charges subject to change. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- 2 Minimum monthly repayments are required and will vary depending on your credit limit.

- 3 Payments may take up to 5 business days to reach your Biller. Certain Biller exclusions apply including but not limited to credit institutions, gambling, share trading, personal loans and DEFT rent. A $2.50 processing fee may be payable for each transaction processed using Zip Pay (to a maximum of $1000) or Zip Money. The amount of the fee will be advised and authorised by You at the time of any relevant bill payment. Exceptions may apply. ® Registered to BPAY Pty Ltd ABN 69 079 137 518

- * Zip Visa Card is available with Zip Pay and Zip Plus. Zip Visa Card T&Cs apply.