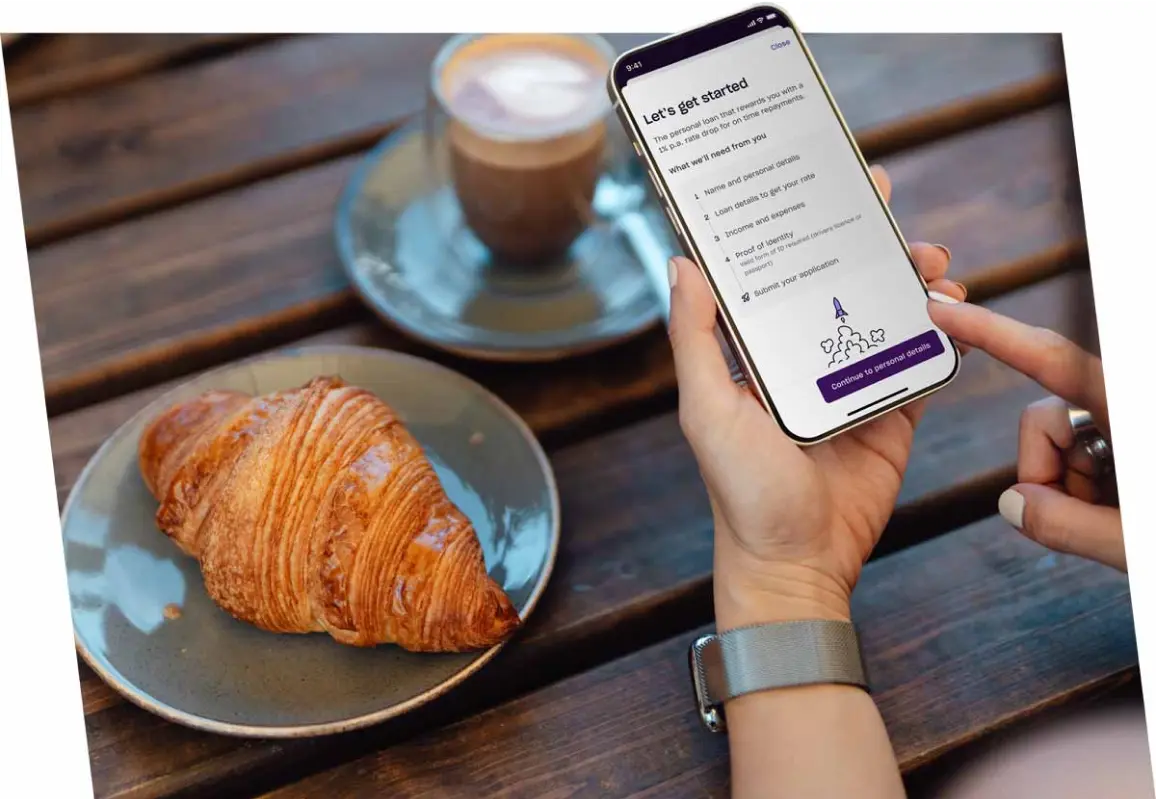

1% p.a. rate drop.

Every. Single. Year.

Repay your Zip accounts on time and be rewarded with a personal loan rate drop on each anniversary of your loan.1

Get started

Fast approval so your plans don’t need to wait

With our 10 minute digital credit application you'll get a response in minutes and your loan funded fast.

Save with a 1% p.a. rate drop every year

Repay your Zip accounts on time every month to get a on your loan anniversary, every single year. This means that for a 7 year loan, the interest rate in your final year could be 6% p.a. lower than your first year. Now that’s rewarding!

Tailor your loan to suit your needs

- Apply for $5,000-$50,000 with no security required (no need to offer an asset like your car or home).

- Loan lengths between 3 to 7 years.

- Choose weekly, fortnightly or monthly repayments.

- No fees for making extra repayments, or for paying off the entire loan early.2

Personalised rates and no hidden fees

Your personalised interest rate will be based on your individual credit score and the details you provide us when you apply.3

Variable interest rate

A comparison rate includes the interest rate as well as fees relating to a loan. This helps you identify the true cost of a loan and compare loans more easily.

Establishment fee

$199 (one-off)

Monthly fee

$9.95

Late payment fee

$25

Early repayment fee

$0 (nada!)

Calculate

estimated

repayments

Pop in your details to get an estimate of your repayments, 5.

LOAN DETAILS

ESTIMATED Monthly REPAYMENTS5

n/aSubject to credit assessment criteria

Example variable

interest rate3

11.99% p.a.

Comparison rate4

12.94% p.a.

Monthly fee

$9.95

Establishment fee

$199

Are you eligible to apply?

- Must be at least 18 years of age

- Be an Australian citizen or permanent resident of Australia

- Be able to demonstrate good repayment history on existing credit accounts

- Maximum loan amount of $15,000 for someone who doesn’t own a home

Over 2 million

Aussies love Zip

Rated 4.9 stars on the App Store

“Zip is everything and more. It has helped me out heaps and because the payments are flexible it’s brilliant.”

App store user forr70“Zip gives me flexibility in my finances and breezes me out whilst shopping whether online or in store.”

App store user Susie dear“Flexible. Reliable”

App store user Ziangnge“Fast and convenient, easy to use and navigate app, flexible payment options.”

App store user Kenfoster1980

Frequently Asked Questions

You can choose a loan term of between 3-7 years.

Repayments are automatically direct debited from the payment method that you added during the application process. Payment methods may be either your primary bank account, by providing your BSB and Account Number or your Debit Card. You can change the payment method at any time.

We’ll give you a minimum monthly repayment, but you will have the flexibility to select the frequency of your repayments to weekly, fortnightly or monthly as long as you're covering the minimum monthly repayments.

Meeting your minimum monthly repayments, on time (across all your Zip accounts), each month in your loan anniversary year, will keep you in the running for the annual 1% p.a. rate drop.

The Zip Personal Loan helps you repay your loan faster with a 1% p.a. interest rate reduction each year, applied on the anniversary of your loan. To be eligible for the interest rate reduction, you need to: Make your minimum monthly repayments by the due date each month (for all your Zip accounts) for every anniversary year of your loan. Your anniversary year begins on the date that we pay the loan funds. Make sure that all your Zip Accounts (Zip Pay, Zip Plus and Zip Money) also have on-time repayments during your Personal Loan anniversary year.

Because our interest rates are variable, they may increase (or decrease!) from time to time. If this happens during your anniversary year, and you are eligible for the annual rate drop, we will still provide you with a 1% p.a. rate drop from the interest rate applicable to your account as at the last day of each anniversary year. If you miss a repayment in an anniversary year, you won't qualify for the rate drop in that year. If you make all your repayments on time in the following anniversary year and meet the eligibility criteria above, you will be eligible for the 1% p.a. rate drop in that anniversary year. For a practical example and more information please visit our Help Centre.

We’ll provide you with a response on your application within minutes!

Once you submit your application, we’ll respond to you within minutes, but it may take up to 1 business day to offer you an approval if you are eligible. We sometimes have follow up questions, but we always aim to get back to you as fast as possible.

If approved, you’ll receive an email confirming your approval and a link to accept your digital contract. Upon acceptance of your contract, we’ll send your loan funds to the bank account that you provided in your application to verify your income. If you need to change this, please contact us before you accept the contract. It can take up to 5 days for the funds to clear in your bank account.

Please note: If you’re borrowing to consolidate existing loans or credit cards, we’ll send your loan funds directly to your creditors to pay them out - so you don’t have to. We’ll ask you for supporting documents when we receive your application, and before we approve it.

To be eligible for a Zip Personal Loan, you’re: 18 years old; An individual borrower; we currently do not offer joint personal loans. An Australian citizen or permanent resident, with an Australian residential address; Have a good credit score and/or good repayment history with Zip; Meet Zip’s credit assessment criteria.

If you’re eligible to apply, you could speed up your application process by having the following handy: Online banking details, which we’ll use to verify your income and expenses. Australian Passport or Driver’s licence. Debit card details for making repayments. Recent statement or payout letters for any debts you wish to consolidate (if you’re borrowing to consolidate existing credit cards or loans)

A Zip Personal Loan is an unsecured loan; which means we won’t use your assets as security against your loan.

Can't find what you're looking for?

References

- Zip Personal Loan: Interest, fees and charges subject to change. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- 1 The rate drop is applied at the end of each anniversary year. To be eligible for an annual rate drop, you must, during the anniversary year, make all repayment amounts by the due date each month on your personal loan and any other accounts you hold with Zip. If you miss any repayments or are in default under your loan agreement or any of your other Zip accounts at any time, you will not be eligible for an annual rate drop on your next anniversary date, but you may be eligible in subsequent anniversary years if you meet the criteria during those anniversary years. You may not receive the full benefit of annual rate drops if the variable interest rate increases, which may happen from time to time.

- 2 Minimum monthly repayments are required. There is no redraw facility available on the loan.

- 3 We determine the interest rate available to you based on your credit score and financial information provided during your application. The interest rate on the Zip Personal Loan ranges between 11.99%p.a. to 21.99%p.a. T&Cs and credit approval criteria apply.

- 4 The comparison rate for the Zip Personal Loan is based on an unsecured loan of $30,000 over a loan term of 5 years. The comparison rate assumes no Annual Rate Drops are applied. WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.

- 5 The estimated repayments and interest rate on this screen is not an offer of credit and is only an estimate only, based on the information input into the calculator. The estimated repayments and interest rate may change and are subject to credit assessment.