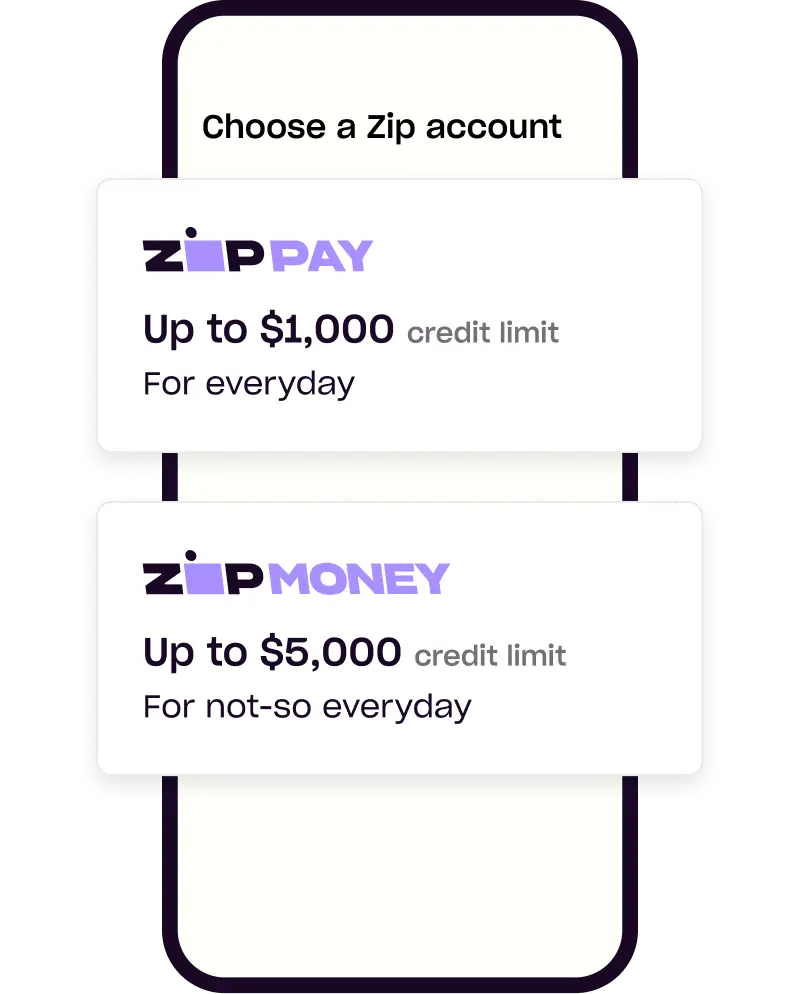

Choose a Zip account that suits you best

Up to $1,000 credit limit

Interest free always on everyday spending

Sign up- $9.95 monthly account fee

- No establishment fee

- Repay from $10/week

- Tap to pay with Zip just about everywhere Contactless Payments are accepted*

Up to $5,000 credit limit

From 3 months interest free for bigger purchases

Sign up- 3-60 months interest free

- $9.95 monthly account fee

- One-off account establishment fee may apply for new customers

- Repay from $10/week or 3% of the outstanding balance (whichever is greater)

Getting started is easy

Choose your account

Sign up in minutes

Download the app

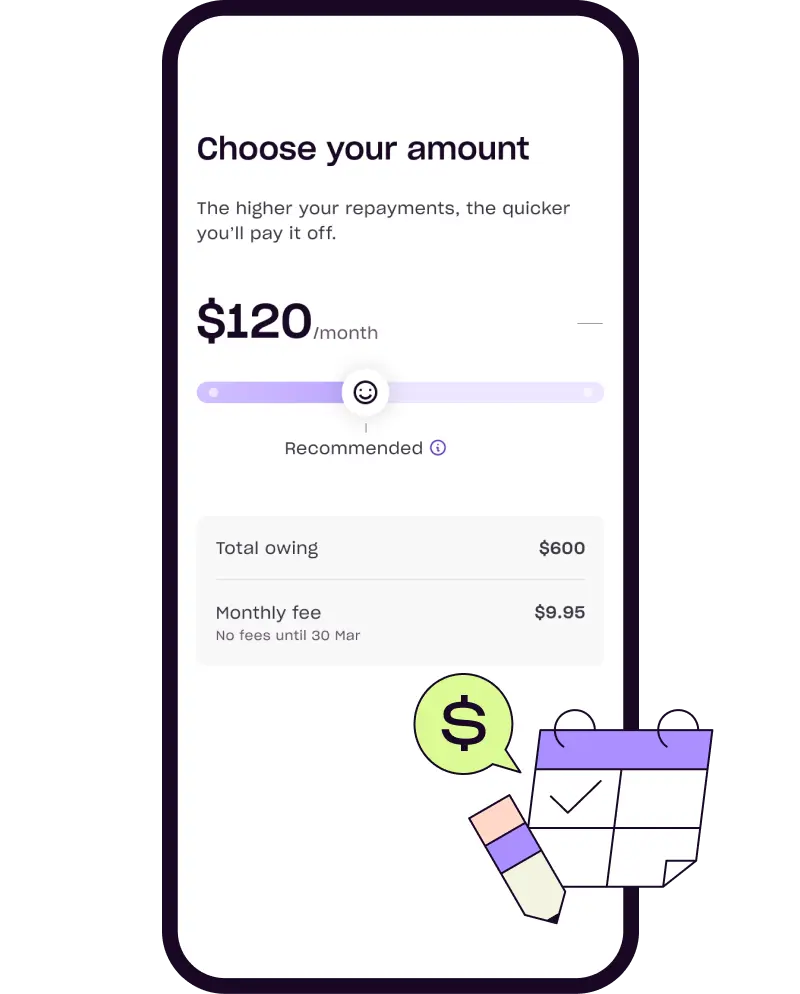

Repay at your own pace

How is Zip different?

Sign up in minutes

Applying is fast and easy so you can start shopping today!

Shop just about

everywhereShop at all your favourite places, online and instore, with the Zip app.

Flexible repayments

Our flexible repayments put you in control by letting you pay later at your own pace.

Frequently Asked Questions

Zip Pay is an interest-free buy-now-pay-later service with a credit limit of up to $10001. Repayments are based on a minimum monthly payment from as little as $10 per week. A $9.95 monthly account fee applies, we will waive the fee if you pay your statement closing balance in full, by the due date. With Zip Pay, you can shop everywhere you see the Contactless Symbol when you add your Zip card to your Apple or Google wallet**.

Zip Money is a line of credit with credit limits between $1,000 and $5,000 for regular accounts and up to $50,000 for specific merchants. Zip Money offers customers a guaranteed interest-free period of 3 months across all products and up to 36 months with some retailers2. Zip Money accounts may incur a one-off establishment fee for certain credit limits. A $9.95 monthly account fee applies.

Both products also feature our Shop Everywhere card, which you can use at any online retailer that accepts Visa**.

References

- * Tap to pay in store available with Zip Pay only. Use the Card everywhere that Visa contactless payments are accepted in store. Card T&Cs apply

- 1 Zip Pay: Minimum monthly repayments are required. A monthly account fee of $9.95 applies and is subject to change. Pay your closing balance in full by the due date each month and we'll waive the fee. Available to approved applicants only and subject to completion of satisfactory credit check. Other charges may be payable. T&Cs apply.

- ** Tap to pay in store available with Zip Pay only. Use the Card everywhere that Visa contactless payments are accepted in store. Card T&Cs apply. Single-use card available with Zip Pay and Zip Money only. Use the Card everywhere that Visa contactless payments are accepted online. Card T&Cs apply.

- 2 Zip Money Instalments: Available to approved applicants only and subject to completion of satisfactory credit check upon application. Instalment plan splits eligible purchases of $300 and above into equal repayments within the interest free period. Eligible purchase excludes Zip bills and gift cards. A monthly account fee of $9.95 applies and a one off establishment fee may apply for new customers. Additional charges may apply, see T&Cs. Under the contract, minimum monthly repayments are required. If you turn off instalments, all future transactions will be reverted to the minimum monthly repayment. Paying only the minimum monthly repayment amount will generally not repay out the purchase within the interest free period. Any balance outstanding at the expiry of the interest free period will be charged at the applicable standard variable interest rate of 25.9% per annum, as at 1 June 2023. Interest, fees and charges are subject to change. Terms & Conditions apply and are available on application. See your contract for further details. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993, Australian Credit Licence Number 441878).