Enjoy a stress-free clinic experience and focus on your furry friends’ comfort

Whether it's a routine check-up or a necessary procedure, Zip helps you manage the expenses with flexible repayment plans. Enjoy the confidence of caring for your pet, and pay it off over time.

How to sign up to Zip Money

New to Zip?

Create your account in minutes

Once approved, you can use Zip at your vet's clinic just like an existing customer (follow steps 1-4 beside)

Existing Zip Customer?

Let your vet know you'd like to pay with Zip.

Go to the 'Pay' tab on the Zip app and select 'Instore'

Generate & Show your barcode at the front desk to pay with Zip

Confirm your purchase and enjoy your pet's treatment

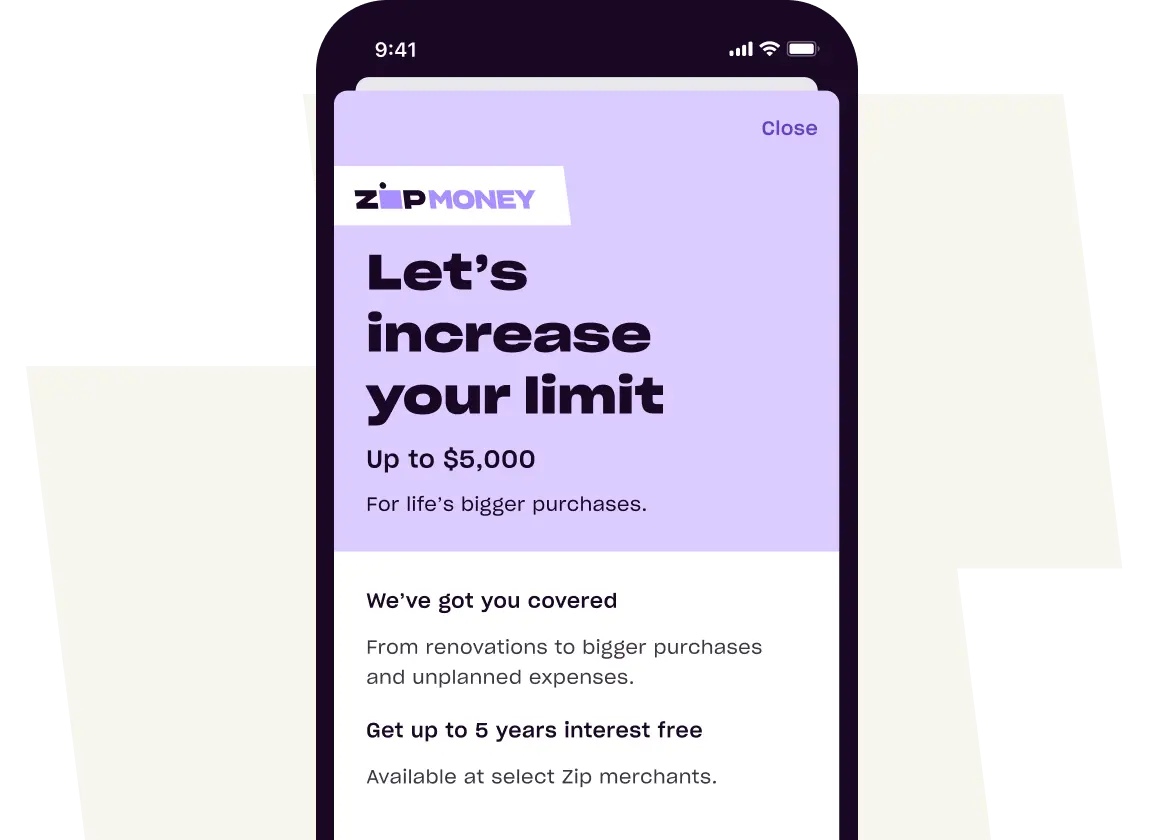

Increase your limit

If your current Zip Money credit limit doesn't cover the entire cost of your pet's treatment, you may be eligible for a credit limit increase.

Submit your request in just minutes - we aim to respond within 48 hours.

Apply for a credit limit increase

How to apply to Zip Money

How Zip Money works

Get startedCredit limits from $1,000 - $50,0001

Flexible repayments from $10/week

No balance, no monthly account fee. Otherwise you’ll pay $9.95.

One-off establishment fee up to $99 may apply

Repay early at any stage with no penalty

What you'll need to apply

Get startedYour mobile number, personal email and employment details

Your residential details

Your online banking login to verify your income

Your passport, driver licence or medicare details

Frequently Asked Questions

If your purchase amount is more than the available funds in your Zip account, you can make a co-payment via remote order with your debit card to cover the difference and complete your purchase.

The maximum co-payment amounts are:

- Zip Pay: $1,000

- Zip Plus: $2,000

- Zip Money: $5,000

You may be eligible for a credit limit increase on your Zip Money account if you meet the following criteria:

- You've had your account for longer than 6 months since your first order.

- You've made consistent repayments on your account for more than 6 months.

- Your account is up-to-date and not overdue.

- You haven't requested a credit limit increase in the last 6 months.

If you meet the above criteria, you can apply for a credit limit increase. Here's how: To request an increase of up to $5,000:

Login to your Digital Wallet

- Click on the Zip Money account tile

- Click the settings tab (located top right-hand corner) > 'Account limit increase'

- We'll be in touch with you shortly to advise if your request was successful.

- In the Mobile app

Login to the Zip app

- Tap on the profile icon (located top right hand corner of the app screen)

- Tap 'Manage Zip Money' > 'Credit limit'

- We'll be in touch with you shortly to advise if your request was successful

To request an increase of over $5,000:

Please submit this form to request a limit increase above $5000, here.

Sometimes when checking out with Zip, you might see the following message:

"Your account is exclusive to a specific merchant".

If your account is exclusive, this means that you are only able to make purchases at the merchant you initially signed up with. This may also be the cause of the issue if your instore code is being rejected at a specific retailer at the point of sale. The good news is, you may be eligible to have your account unlocked for general use. Please be aware, you may be assessed for a lower limit as part of this process.

References

- T&Cs, fees and credit approval apply. Other charges may be payable. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- 1 Zip Money: The interest free period is the maximum period of time when no interest is charged on the purchase. The availability of the interest free period for a purchase will depend on the purchase amount, the minimum monthly repayment and account status. Minimum monthly repayments are required and vary according to credit limit. Minimum monthly repayments may require repayment of the purchase prior to the expiry of the maximum interest free period. In other cases, paying only the minimum monthly repayment may not repay the purchase in the interest free period. Any purchase amount outstanding at the expiry of the interest free period will be charged at the standard variable interest rate, 25.9% per annum, as at 1 June 2023. Zip Money is available to approved applicants and subject to completion of a satisfactory credit assessment. A monthly account fee of $9.95 applies and a one-off establishment fee may apply for new customers. Other charges may be payable, see T&Cs. Interest, fees and charges are subject to change. Terms and Conditions apply and are available on application. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- Apple, Apple Pay and the Apple App Store are trademarks of Apple Inc., registered in the U.S. and other countries and regions. Google, Google Pay, Google Play and the Google Play logo are trademarks of Google LLC. VISA is a trademark owned by Visa International Service Association and used under license. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC.