Shop with Zip this Black Friday!

The Black Friday sales are over

Don’t worry it’s the perfect time to grab an awesome deal and get a head start on your Christmas shopping.

Men's Fashion

Kids

Electronics

Home & Office

Health & Beauty

Sports & Recreation

Travel

Miscellaneous

Food & Drink

Women's Fashion

All deals A-Z

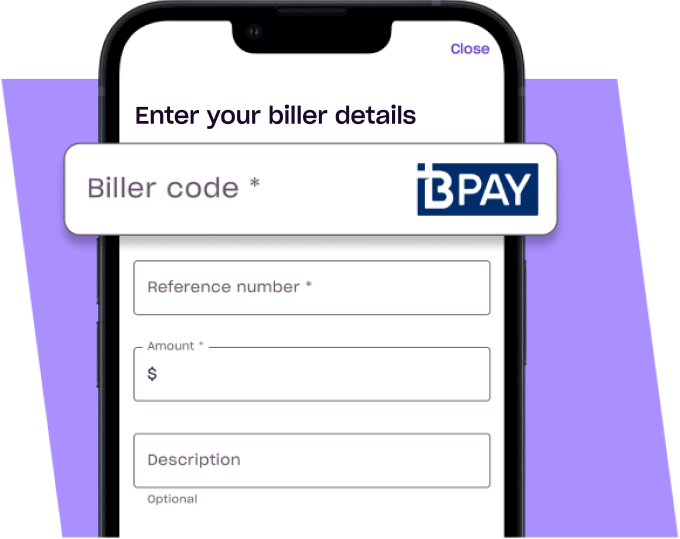

Tax-time bills sorted with Zip*

Free up more cash to enjoy the fun stuff. Get your bills sorted via BPAY® now, pay later at your pace.

Gift cards for one and all^

Treat future you or someone you love. Discover Zip gift cards from over 200+ stores.

References

- T&Cs, fees and credit approval apply. Other charges may be payable. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- * Payments may take up to 5 business days to reach your Biller. Certain Biller exclusions apply including but not limited to credit institutions, gambling, share trading, personal loans and DEFT rent. A $2.50 processing fee may be payable for each transaction processed using Zip Pay (to a maximum of $1000) or Zip Money. The amount of the fee will be advised and authorised by You at the time of any relevant bill payment. Exceptions may apply. ® Registered to BPAY Pty Ltd ABN 69 079 137 518

- ^ Gift card T&Cs apply.