Spend your

day with Zip

Enjoy flexible repayment options.

Just about everywhere.

For your everyday,

plus more.Up to $20K, interest free when your end of month balance is below $1,500.2

Sign up nowFor life's

milestones.Up to $50K with an annual 1% p.a. rate drop for on-time repayments.4

Sign up now

Download the Zip app

Millions of shoppers globally and counting

For your everyday,

there's Zip Pay

Apply for up to $1,000 to spend, interest free always.

Zip Pay helps you navigate day-to-day life with ease by spreading the cost of your purchases over time. You'll pay nothing upfront, and repay weekly, fortnightly or monthly on a schedule that suits you, with no interest ever. With Zip, you're more in control of whatever comes your way.

For your everyday,

plus more

Apply for up to $20,000 to spend everywhere with Visa.

Book that weekend away or transform your living space. Whatever tomorrow holds, nothing is holding you back. Nothing to pay today and no hidden fees. Interest free when your end of month balance is under $1,500. And a low rate of 12.95% p.a. when it's over $1,500. Now that's a new kind of card that rewards you for staying on top of your balance.

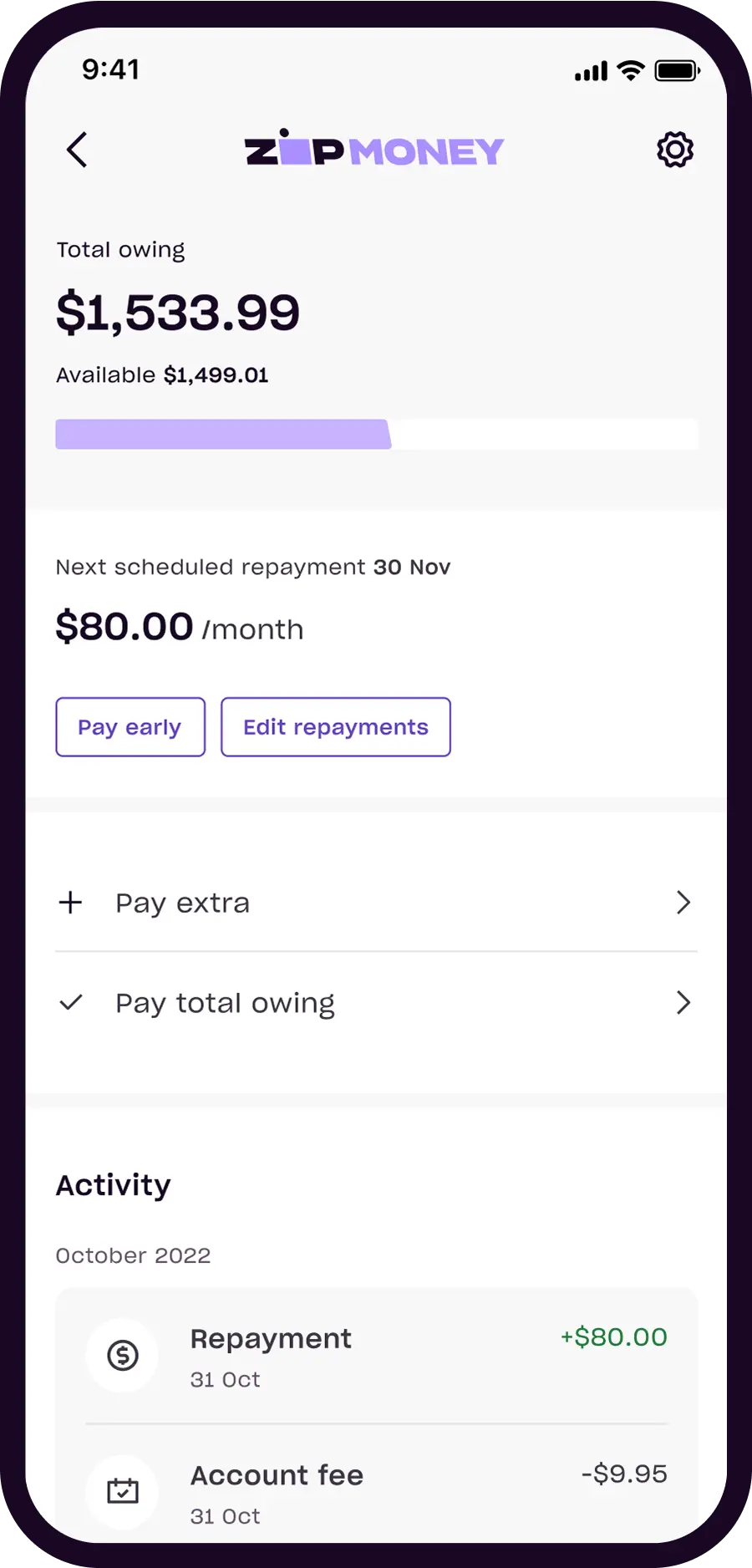

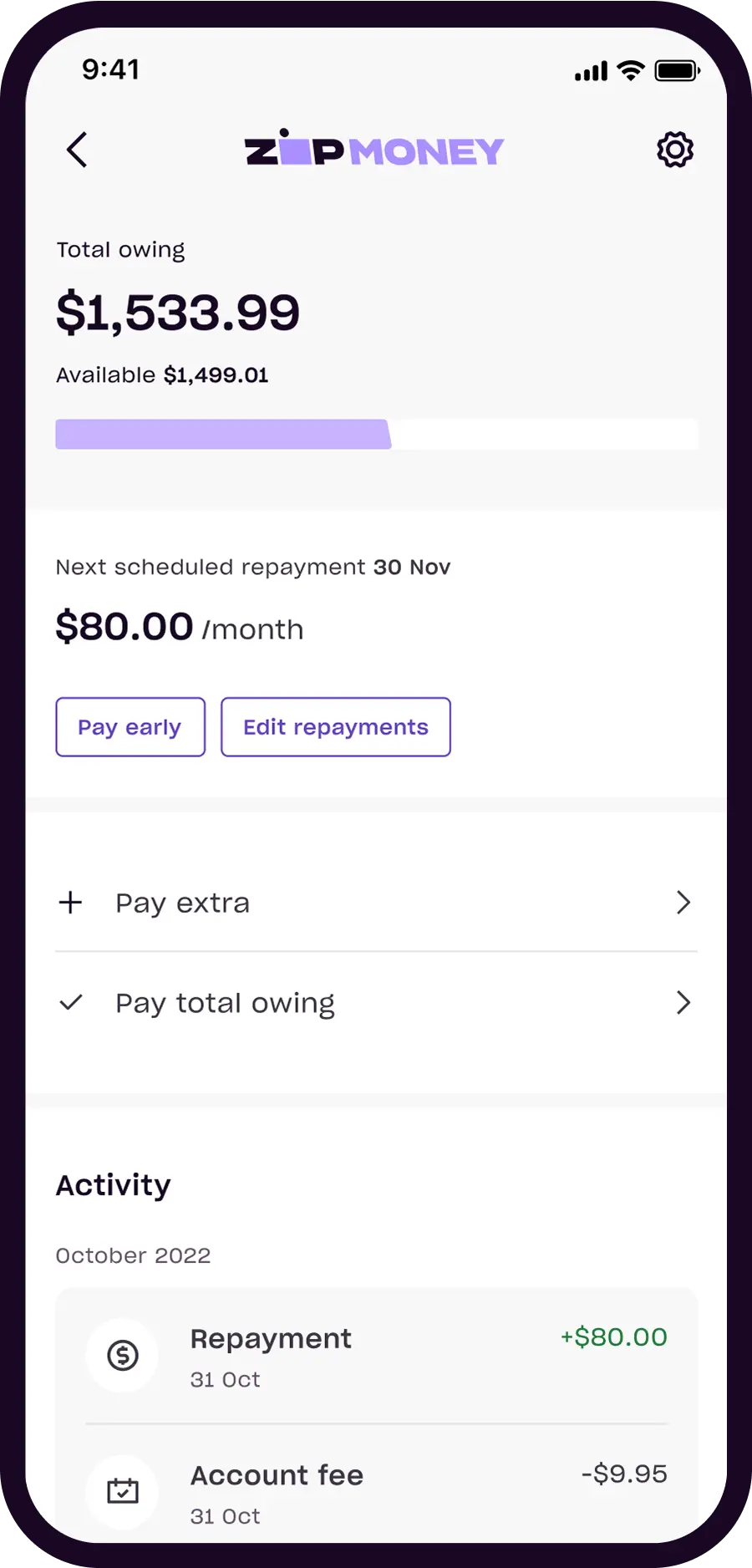

For your not-so-everyday, there's

Zip Money

Apply for up to $5,000 credit to help you pay for your next step in life, every step of the way.

For the expected and unexpected. For renovations and celebrations. Interest free terms available at select Zip merchants, Zip Money is there for you when you need it the most.

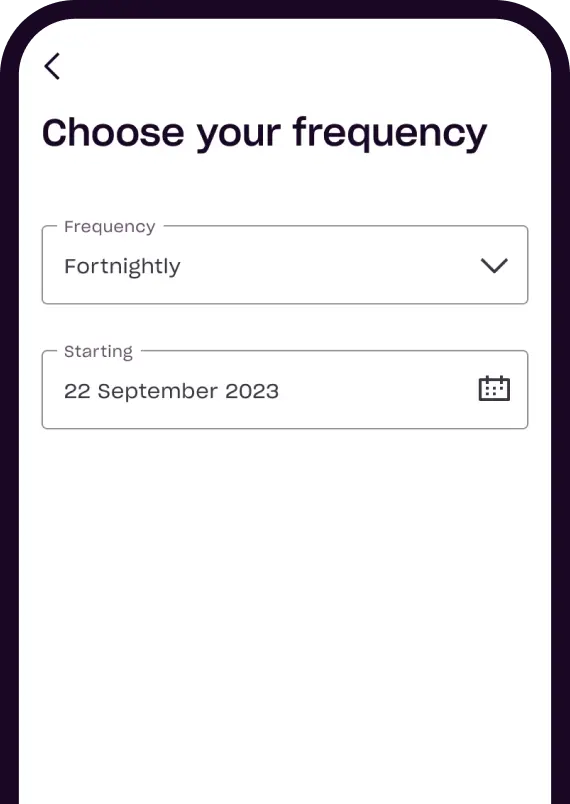

Repayment flexibility

We're not like the others. We'll bundle your purchases and let you align your repayments to suit your pay cycle.

Repay on a convenient weekly, fortnightly or monthly schedule.

Problem with a purchase?

No problem

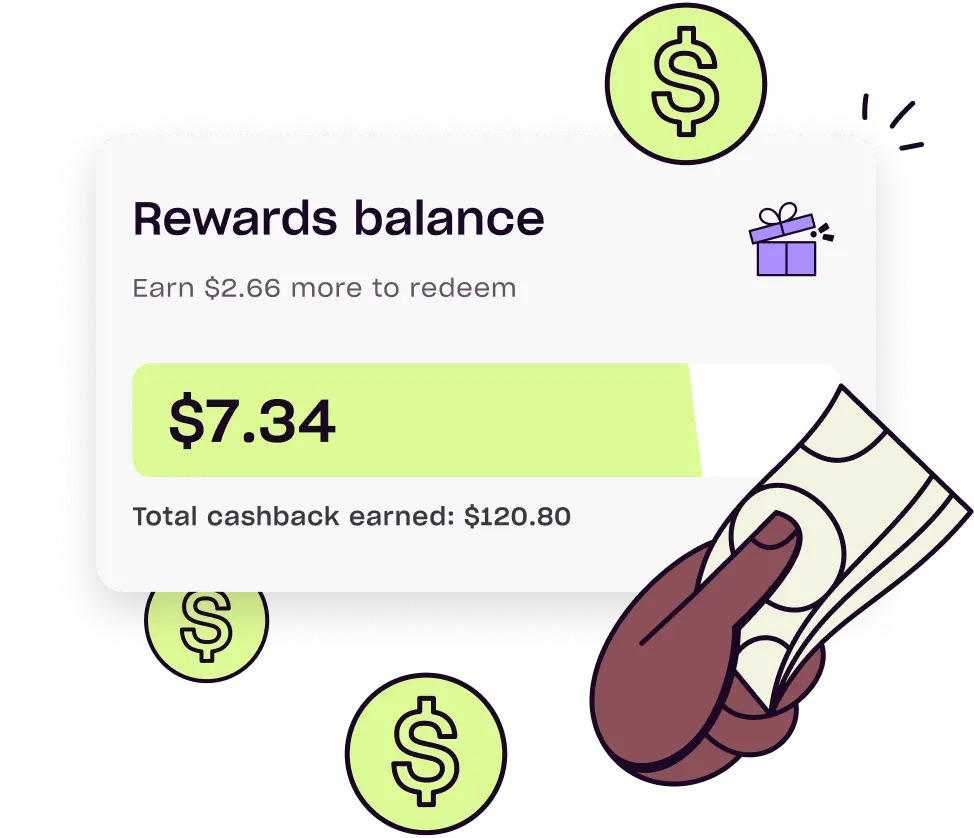

Earn instant cashback

Not only are we flexible, we're rewarding too. Earn instant cashback when shopping at our rewards partners.

Download the Zip app to browse and activate our range of offers.*

Shop cashback offers

All your purchases.

All the ways to pay.

All spread over time.

Visa card for everywhere

With the Zip Visa Card, you can spend anywhere Visa is accepted - both online and instore.**

Pay BPAY® Billers

Pay your bills and repay us on a schedule that suits you, spreading the cost over time.5

Choose Zip at checkout

Speed through checkout at over 58,000 Zip merchants.

Safer online shopping

Generate a single-use Visa card for extra security when shopping online. They work anywhere Visa is accepted and expire after one purchase.***

All this and lots more.

All inside the Zip app.

Loved by millions of shoppers globally and counting

In Love with Zip Pay.

I wish I could give them more than 5 stars! Lucky to be born in the world of Zip, helped me get through many difficult times. Thank you so much Zip Pay. I love you!

VerifiedInvaluable

I have been using ZIP for a few years now! And I love it. It’s now my “go to” way of paying that offers great flexibility, availability and more importantly, accessibility!

VerifiedZip is the best among them

I’ve used all the other platforms, and I think none is close to Zip. The flexibility and unlimited nature of transactions from BPay to Credit Card to in app purchasing. None of the others come near to it.

VerifiedJust love knowing I have Zip

I feel I have my own independence being able to have a system like Zip. I can purchase items I love for myself and for others too. To be able to pay back what I can afford without breaking the budget.

VerifiedI CAN USE THIS ANYWHERE!

Literally - In Store or Online - Virtually on ANY (well almost) kind of purchase.

VerifiedAlways there

If find Zip really easy to use and always there when I need them. Hassle free and paying back is easy too.

VerifiedGreat service

Very secure and flexible, great to use.

VerifiedFrequently Asked Questions

Zip Pay is an interest free buy now pay later product offering a credit limit of up to $1,0001. You can buy what you love and enjoy the flexibility of paying it off over time.

- Apply in under 4 minutes and start shopping instantly once approved -Instant access to a digital Visa card that works online and instore, anywhere Visa is accepted **

- Repay from $10/week A $9.95 monthly account fee applies, waived if nothing owing.

Zip Plus is a great value digital card with interest free and waived fee options. You’ll have more spending power than Zip Pay, with access to a credit limit of $2,000-20,0002.

- Use Zip Plus instore and online everywhere Visa is accepted

- Reduce your owing balance to $1,500 at the end of each month and you’ll pay no interest at all. If your owing balance is over $1,500 at the end of the month, a low interest rate of 12.95% p.a applies.

- Repay from $20/week

- Shop globally, with no foreign transaction fees

- A $9.95 monthly account fee applies, waived if there is no balance owing at the end of each month.

Zip Money is a line of credit with limits between $1,000 and $5,000 when customers apply directly with Zip, or $50,000 when customers apply through select Zip merchants. Up to 5 years interest free terms available3.

- Repay from $10/week

- A one-off establishment fee for certain credit limits may apply

- A $9.95 monthly account fee applies, waived if nothing owing at the end of each month.

- Repayments are automatically direct debited from the payment method that you added when you created the account. You can change the payment method at any time and the frequency of your payments to weekly, fortnightly or monthly as long as you're covering the minimum monthly repayments. Choose what works best for you.

Zip Pay:

- Monthly Account Fee: $9.95 (waived if you pay your statement closing balance in full by the due date).

- Late Fee: $7.50 if you miss the minimum repayment, charged 7 days after your due date.

- BPAY Bill Payment Fee: $2.50 per bill payment.

- Foreign Exchange Fee: If you use a Zip Visa Card or a Single-Use Card to make a 'Foreign Transaction' (being a transaction made with a merchant or processed by a financial institution located outside Australia), a fee charged at 3% of the value of the foreign transaction.

Zip Plus:

- Monthly Account Fee: $9.95 (waived if you do not have an outstanding balance at the end of the month).

- Interest:

- 12.95% p.a. if your balance is over $1,500.

- No interest if your balance is $1,500 or less.

- Late Fee: $15 if the minimum repayment isn’t made, charged 7 days after your due date.

Zip Money:

- Monthly Account Fee: $9.95 (waived if you do not have an outstanding balance at the end of the month).

- One-off Establishment Fee: $0 - $99, depending on your approved credit limit.

- Late Fee: $15 if the minimum repayment isn’t made, charged 7 days after your due date.

- BPAY Bill Payment Fee: $2.50 per bill payment.

- Foreign Exchange Fee: If you use a Single-Use Card to make a 'Foreign Transaction' (being a transaction made with a merchant or processed by a financial institution located outside Australia), a fee charged at 3% of the value of the foreign transaction.

Zip Personal Loan:

- Monthly Account Fee: $9.95

- One-off Establishment Fee: $199 applied to the balance owing on your loan once disbursed.

- Late Fee: $25 if the minimum repayment isn’t made, charged 21 days after your due date.

Can't find what you're looking for?

References

- T&Cs, fees and credit approval apply. Other charges may be payable. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- Apple, Apple Pay and the Apple App Store are trademarks of Apple Inc., registered in the U.S. and other countries and regions. Google, Google Pay, Google Play and the Google Play logo are trademarks of Google LLC. VISA is a trademark owned by Visa International Service Association and used under license. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC.

- 1 Zip Pay: Minimum monthly repayments are required. A monthly account fee of $9.95 applies and is subject to change. Pay your closing balance in full by the due date each month and we’ll waive the fee. Available to approved applicants only and subject to completion of satisfactory credit assessment. Other charges may be payable. Fees and charges subject to change. T&Cs apply. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878. Visit zip.co/au/zip-pay to find out more.

- 2 Zip Plus: Interest accrues daily on the total balance owing at the end of each day. No interest will be charged to your account in a given month if the balance owing at the end of the last day of that calendar month is $1,500 or less. Each day ends at 11:59pm AEST (AEDT during daylight savings). Standard interest rate is 12.95% p.a. T&Cs and credit approval criteria apply. A monthly account fee of $9.95 will apply if the total balance owing is not paid in full by the end of the last day of the calendar month. Interest and other charges may be payable, see T&Cs. Interest, fees and charges subject to change. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- 3 Zip Money: The interest free period is the maximum period of time when no interest is charged on the purchase. The availability of the interest free period for a purchase will depend on the purchase amount, the minimum monthly repayment and account status. Minimum monthly repayments are required and vary according to credit limit. Minimum monthly repayments may require repayment of the purchase prior to the expiry of the maximum interest free period. In other cases, paying only the minimum monthly repayment may not repay the purchase in the interest free period. Any purchase amount outstanding at the expiry of the interest free period will be charged at the standard variable interest rate, 25.9% per annum, as at 1 June 2023. Zip Money is available to approved applicants and subject to completion of a satisfactory credit assessment. A monthly account fee of $9.95 applies and a one-off establishment fee may apply for new customers. Other charges may be payable, see T&Cs. Interest, fees and charges are subject to change. Terms and Conditions apply and are available on application. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- 4 The rate drop is applied at the end of each anniversary year. To be eligible for an annual rate drop, you must, during the anniversary year, make all repayment amounts by the due date each month on your personal loan and any other accounts you hold with Zip. If you miss any repayments or are in default under your loan agreement or any of your other Zip accounts at any time, you will not be eligible for an annual rate drop on your next anniversary date, but you may be eligible in subsequent anniversary years if you meet the criteria during those anniversary years. You may not receive the full benefit of annual rate drops if the variable interest rate increases, which may happen from time to time.

- * Rewards are redeemable when you reach the Rewards Goal. See Promotion and Reward Program T&Cs for more details. Zip may earn a commission.

- ** Zip Visa Card is available with Zip Pay and Zip Plus. Zip Visa Card T&Cs apply.

- *** Zip Single-use card T&Cs apply

- 5 Payments may take up to 5 business days to reach your Biller. Certain Biller exclusions apply including but not limited to credit institutions, gambling, share trading, personal loans and DEFT rent. A $2.50 processing fee may be payable for each transaction processed using Zip Pay (to a maximum of $1000) or Zip Money. The amount of the fee will be advised and authorised by You at the time of any relevant bill payment. Exceptions may apply. ® Registered to BPAY Pty Ltd ABN 69 079 137 518