Ready to apply for Zip Money?

Apply for Zip Money to access credit limits up to $2,000 and interest free periods of up to 6 months when you shop at The Healthy Mummy

How to apply to Zip Money

How Zip Money works

Get startedCredit limits from $1,000 - $2,0001

From $10/week flexible repayments1

No balance, no monthly account fee. Otherwise you’ll pay $9.95.

One-off establishment fee up to $99 may apply

Repay early at any stage with no penalty

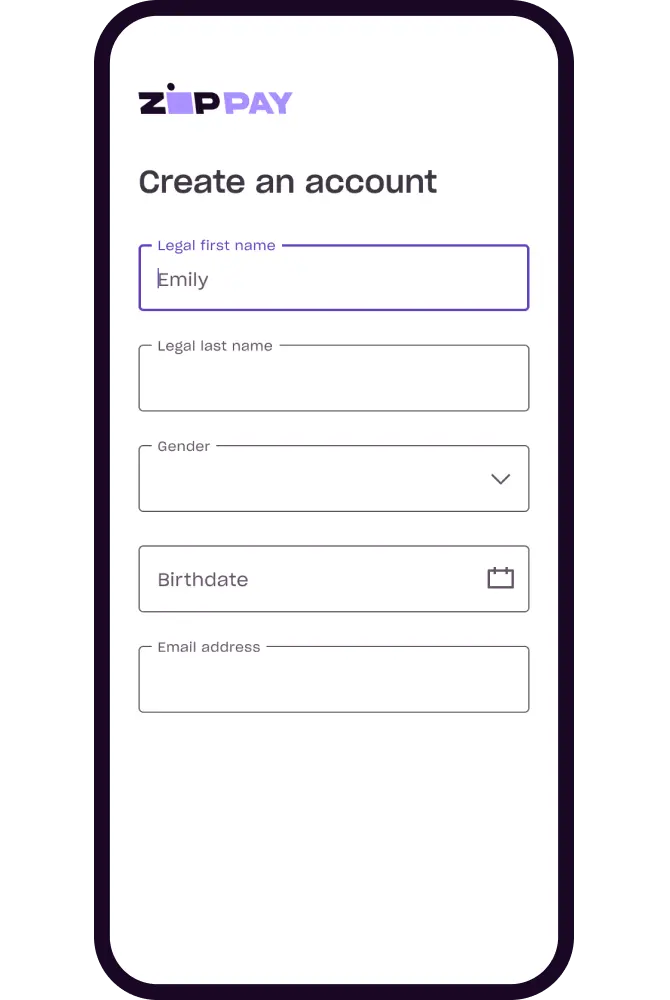

What you'll need to apply

Get startedYour mobile number, personal email and employment details

Your residential details

Your online banking login to verify your income

Your passport, driver licence or medicare details

Why choose Zip?

Sign up in minutes

Applying is fast and easy so you can start shopping today!

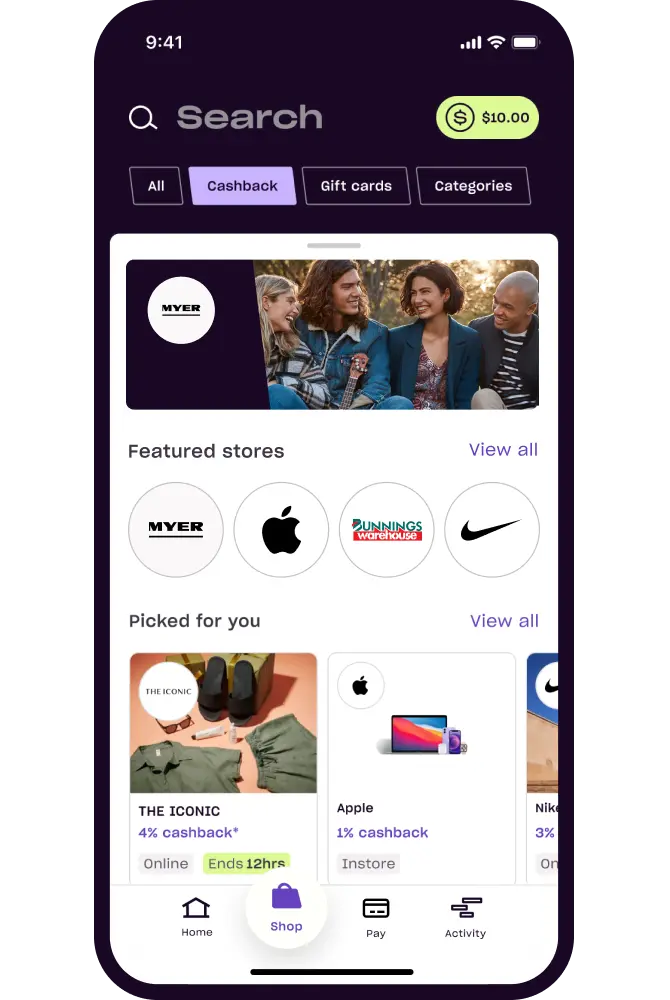

Shop just about everywhere

Shop at all your favourite places, online and instore, with the Zip app.

Flexible repayments

You're in control by paying later at your own pace.

How to pay with Zip at The Healthy Mummy in 3 simple steps

Apply for a Zip account in minutes

Shop at The Healthy Mummy online

Pay with a Single-Use Card* in the app, or select Zip at checkout

Loved by millions of shoppers globally and counting

In Love with Zip Pay.

I wish I could give them more than 5 stars! Lucky to be born in the world of Zip, helped me get through many difficult times. Thank you so much Zip Pay. I love you!

VerifiedInvaluable

I have been using ZIP for a few years now! And I love it. It’s now my “go to” way of paying that offers great flexibility, availability and more importantly, accessibility!

VerifiedZip is the best among them

I’ve used all the other platforms, and I think none is close to Zip. The flexibility and unlimited nature of transactions from BPay to Credit Card to in app purchasing. None of the others come near to it.

VerifiedJust love knowing I have Zip

I feel I have my own independence being able to have a system like Zip. I can purchase items I love for myself and for others too. To be able to pay back what I can afford without breaking the budget.

VerifiedI CAN USE THIS ANYWHERE!

Literally - In Store or Online - Virtually on ANY (well almost) kind of purchase.

VerifiedAlways there

If find Zip really easy to use and always there when I need them. Hassle free and paying back is easy too.

VerifiedGreat service

Very secure and flexible, great to use.

Verified- Millions of Zip customers across Australia, New Zealand and the US

- Over 58,000 merchants across Australia and New Zealand

- 4.9/5 App Store rating from over 330K reviews

About The Healthy Mummy

The aim of The Healthy Mummy has always been to empower mums to live a healthier life and it started off with just a few hundred mums using the programs on Facebook to now – 8 years later over 825,000 mums being part of The Healthy Mummy Community and transforming their health, life and body on The Healthy Mummy Plans. We understand that mums want choice, flexibility and support when working towards weight loss goals. We designed this program to give you everything you need to lose weight and improve your health in a supportive, friendly environment.Zip may earn a commission

Visit storeHave a question?

Here are some FAQs to help you get to know Zip better.

Zip Pay is an interest free buy now pay later product offering a credit limit of up to $1,0002. You can buy what you love and enjoy the flexibility of paying it off over time.

- Apply in under 4 minutes and start shopping instantly once approved -Instant access to a digital Visa card that works online and instore, anywhere Visa is accepted *

- Repay from $10/week A $9.95 monthly account fee applies, waived if nothing owing.

Zip Plus is a great value digital card with interest free and waived fee options. You’ll have more spending power than Zip Pay, with access to a credit limit of $2,000-20,0003.

- Use Zip Plus instore and online everywhere Visa is accepted

- Reduce your owing balance to $1,500 at the end of each month and you’ll pay no interest at all. If your owing balance is over $1,500 at the end of the month, a low interest rate of 12.95% p.a applies.

- Repay from $20/week

- Shop globally, with no foreign transaction fees

- A $9.95 monthly account fee applies, waived if there is no balance owing at the end of each month.

Zip Money is a line of credit with limits between $1,000 and $5,000 when customers apply directly with Zip, or $50,000 when customers apply through select Zip merchants. Up to 5 years interest free terms available1.

- Repay from $10/week

- A one-off establishment fee for certain credit limits may apply

- A $9.95 monthly account fee applies, waived if nothing owing at the end of each month.

- Repayments are automatically direct debited from the payment method that you added when you created the account. You can change the payment method at any time and the frequency of your payments to weekly, fortnightly or monthly as long as you're covering the minimum monthly repayments. Choose what works best for you.

Zip Pay:

- Monthly Account Fee: $9.95 (waived if you pay your statement closing balance in full by the due date).

- Late Fee: $7.50 if you miss the minimum repayment, charged 7 days after your due date.

- BPAY Bill Payment Fee: $2.50 per bill payment.

- Foreign Exchange Fee: If you use a Zip Visa Card or a Single-Use Card to make a 'Foreign Transaction' (being a transaction made with a merchant or processed by a financial institution located outside Australia), a fee charged at 3% of the value of the foreign transaction.

Zip Plus:

- Monthly Account Fee: $9.95 (waived if you do not have an outstanding balance at the end of the month).

- Interest:

- 12.95% p.a. if your balance is over $1,500.

- No interest if your balance is $1,500 or less.

- Late Fee: $15 if the minimum repayment isn’t made, charged 7 days after your due date.

Zip Money:

- Monthly Account Fee: $9.95 (waived if you do not have an outstanding balance at the end of the month).

- One-off Establishment Fee: $0 - $99, depending on your approved credit limit.

- Late Fee: $15 if the minimum repayment isn’t made, charged 7 days after your due date.

- BPAY Bill Payment Fee: $2.50 per bill payment.

- Foreign Exchange Fee: If you use a Single-Use Card to make a 'Foreign Transaction' (being a transaction made with a merchant or processed by a financial institution located outside Australia), a fee charged at 3% of the value of the foreign transaction.

Zip Personal Loan:

- Monthly Account Fee: $9.95

- One-off Establishment Fee: $199 applied to the balance owing on your loan once disbursed.

- Late Fee: $25 if the minimum repayment isn’t made, charged 21 days after your due date.

References

- T&Cs, fees and credit approval apply. Other charges may be payable. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- 1 Zip Money: The interest free period is the maximum period of time when no interest is charged on the purchase. The availability of the interest free period for a purchase will depend on the purchase amount, the minimum monthly repayment and account status. Minimum monthly repayments are required and vary according to credit limit. Minimum monthly repayments may require repayment of the purchase prior to the expiry of the maximum interest free period. In other cases, paying only the minimum monthly repayment may not repay the purchase in the interest free period. Any purchase amount outstanding at the expiry of the interest free period will be charged at the standard variable interest rate, 25.9% per annum, as at 1 June 2023. Zip Money is available to approved applicants and subject to completion of a satisfactory credit assessment. A monthly account fee of $9.95 applies and a one-off establishment fee may apply for new customers. Other charges may be payable, see T&Cs. Interest, fees and charges are subject to change. Terms and Conditions apply and are available on application. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.

- * Zip Visa Card is available with Zip Pay and Zip Plus. Zip Visa Card T&Cs apply.

- 2 Zip Pay: Minimum monthly repayments are required. A monthly account fee of $9.95 applies and is subject to change. Pay your closing balance in full by the due date each month and we’ll waive the fee. Available to approved applicants only and subject to completion of satisfactory credit assessment. Other charges may be payable. Fees and charges subject to change. T&Cs apply. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878. Visit zip.co/au/zip-pay to find out more.

- 3 Zip Plus: Interest accrues daily on the total balance owing at the end of each day. No interest will be charged to your account in a given month if the balance owing at the end of the last day of that calendar month is $1,500 or less. Each day ends at 11:59pm AEST (AEDT during daylight savings). Standard interest rate is 12.95% p.a. T&Cs and credit approval criteria apply. A monthly account fee of $9.95 will apply if the total balance owing is not paid in full by the end of the last day of the calendar month. Interest and other charges may be payable, see T&Cs. Interest, fees and charges subject to change. Credit provided by ZipMoney Payments Pty Ltd (ABN 58 164 440 993), Australian Credit Licence Number 441878.